2023 Holiday Planning and What Companies can do to Prepare Ahead in this Economic Climate

By Christian Piller, Pollen Returns

Retailers – from the Small and Midsize Business (SMB) to the Fortune 500 – have significant capital invested in inventory because it is a fundamental input to metrics like revenue, profit, and consumer satisfaction. Retailers have extensive planning processes that include sophisticated mathematical models, state-of-the-art technology, and expert consultants that help them optimize inventory to ensure they have what their customers want, when they want it, without holding too much that it unnecessarily consumes capital. These processes include demand, availability, seasonality, casuals (think about a book being on The New York Times Bestseller list), supplier lead times, inbound / outbound transit times, variability for each, etc. The problem? Lack of investment in returns experiences and processes means this extensive planning does not effectively incorporate returns which happens with 20% of eCommerce sales; higher in some segments like try before you buy and apparel rentals. In effect, retailers are not utilizing 20% of their inventory.

Retailers are throwing money away. eCommerce revenue is the highest it has ever been, expected to exceed $1 trillion in the United States alone next year and continue to grow 11.2% annually through 20271. The 20% return rate has remained constant since retailers offered free returns by policy in response to Zappos’ success in the early 2000s, so the value and number of returns have increased with eCommerce but supporting functions and policies have not. The main challenge with this returns growth, in the current state, is that only about 30% of returns, a smaller percentage of returns than many consumers realize, are resold as it can be cheaper to liquidate (30%) or send the returns to a landfill which happens to as much as 40% of returns2. Retailers use a network of third-party product disposition companies to handle much of the dark side of returns but the outcome remains unchanged. For example, a retailer that had $7 billion in eCommerce in 2007 and grew to $24 billion in 2022 saw the value of their returns go from $1.4 billion to $4.8 billion with as much as $1.9 billion being sent to landfill.

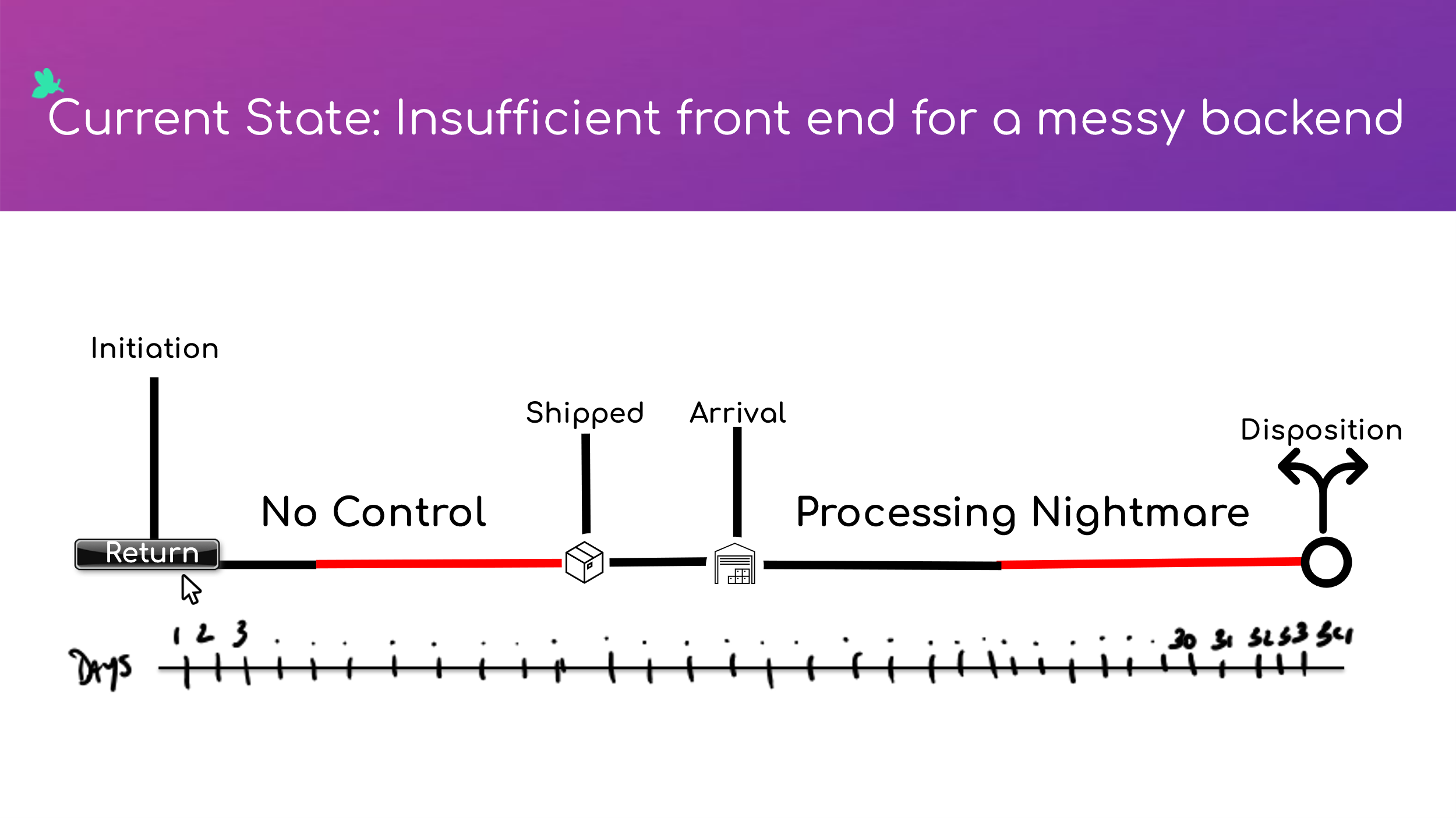

Returns end up in a landfill for a variety of reasons, mainly because the returns process takes too long. (We will leave the environmental impact of returns for another time.) Consumers typically take about 90% of their allowable returns window to physically return their item once their return has been approved by the retailer which is a total of 4-6 weeks with the now standard 30–45-day return policies plus the additional 3-4 weeks it takes the retailer (or their third-party product disposition company) to process the item which includes validating the product, grading the product, and/or refurbishing the product to be resold (Grade A), liquidated (Grade B), or landfill (Grade C). This is increasingly difficult to ignore which is why retailers must do a better job of incorporating returns into their holiday planning processes by upgrading their returns processes and systems and updating their returns experience.

To effectively incorporate returns into holiday planning, retailers must rethink their returns processes, systems, and experiences by implementing the following:

- Reduce the return rate. Several retailers are exploring ways to reduce the return rate by creating a virtual store to ask experts questions (Best Buy3), highlighting if a product is frequently returned by other customers (Amazon), or offering feedback on how items typically fit. While these efforts may reduce the return rate slightly, they are unlikely to have a significant impact on America’s returns culture, so the current state needs to be redesigned.

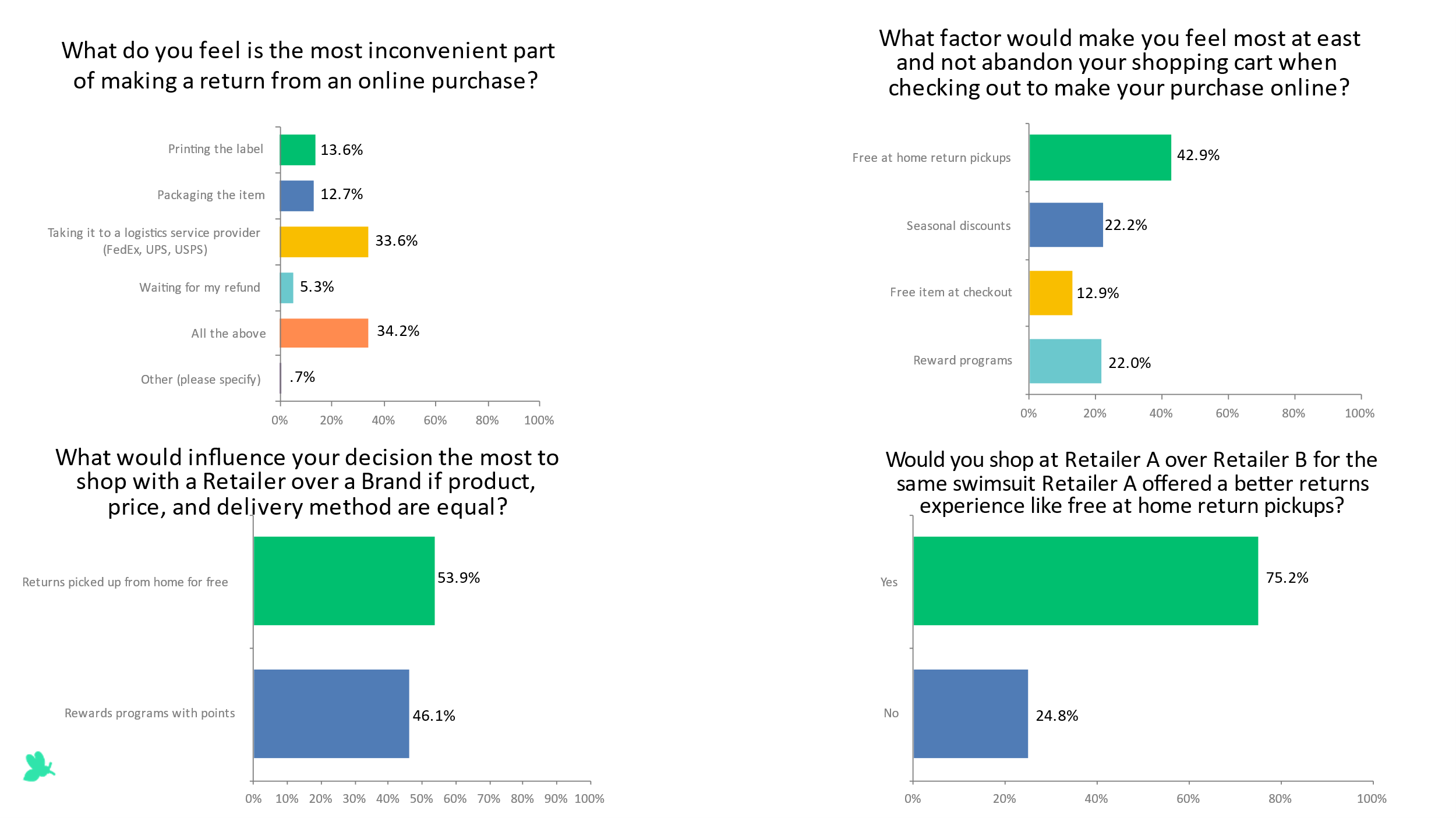

- Challenge the status quo of returns. The current state of returns is becoming increasingly expensive for retailers and it is inconvenient for the consumers. According to a survey by Pollen, 33.6% of consumers said the most inconvenient part of making an online purchase was bringing a return to a carrier or retail location; 13.6% printing the label; 12.7% packaging the item; 5.3% waiting for a refund; and 34.2% said all the above. Some retailers have decided to handle the former by making the latter even more inconvenient by charging the consumer to make a return – only 8% of consumers said they would pay for a return.

The future state of returns is free to the consumer, at-home pickups for less than what retailers are paying for the current state of returns. This solves both the retailers’ expense and the consumers’ inconvenience.

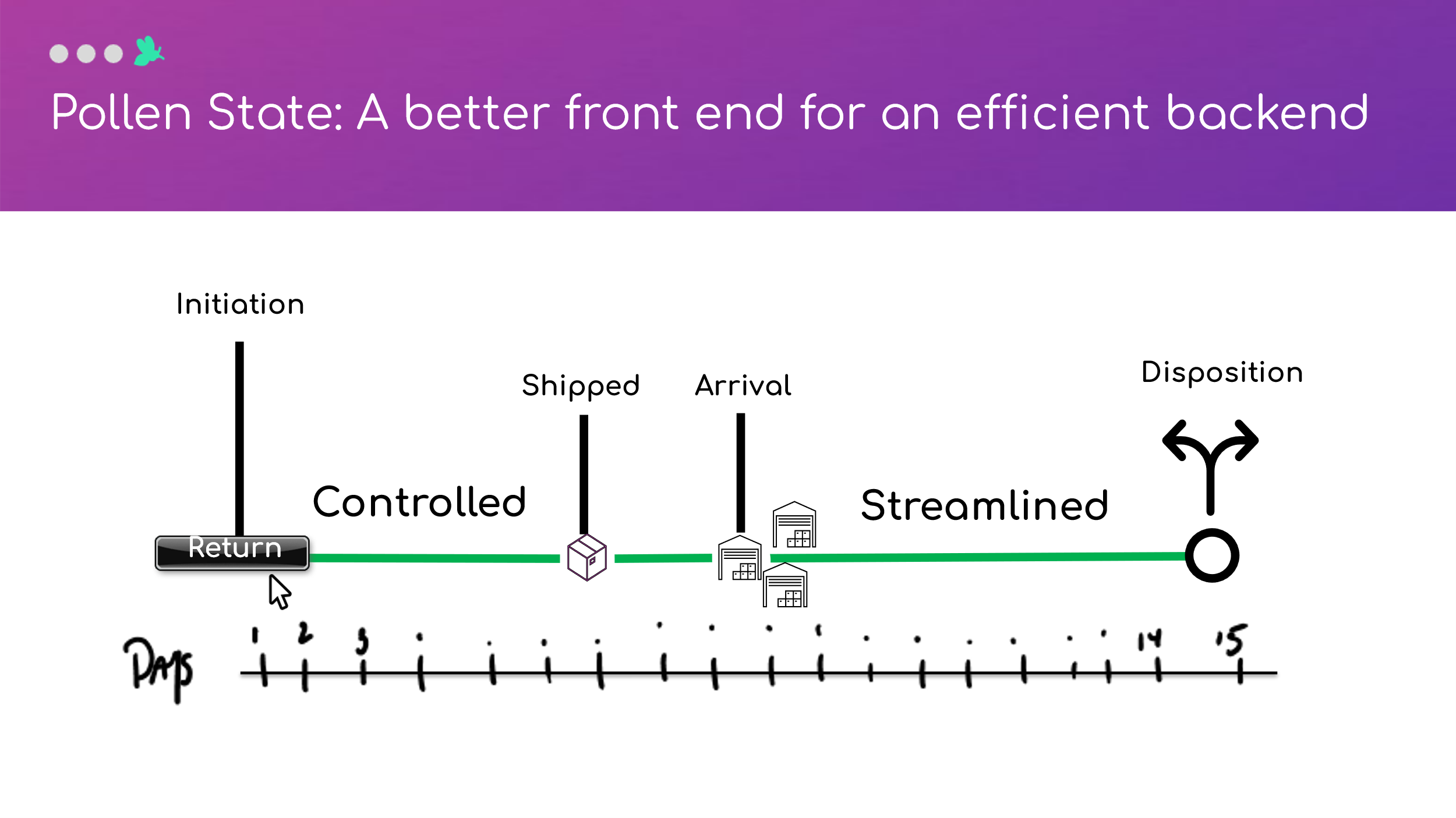

- Improving consumer experience reduces the amount of time the retailer waits for a return which enables more effective planning processes. If retailers do not know when consumers will drop off their returns then retailers do not know when it will be processed, so they struggle to include those return items as part of their inventory planning process to make them available for resale.

The future state of returns pickups from consumers’ doorsteps offers consumers the ability to choose a convenient pickup time, like how deliveries are scheduled, which removes friction, so the items are returned faster. For the retailer, this improves control and increases visibility to

have a more efficient returns process with better data to incorporate into planning processes, the retailer will be able to plan inventory more effectively by shifting resellable returns from landfill and liquidation.

- Start product validation, grading, and refund processes sooner. In the current state, return items are not physically inspected by anyone for weeks after the return is dropped off at a retail or carrier location by the consumer. Once received at a product disposition facility, each box is opened and the item inspected by someone – this takes a lot of time (and money).

The future of returns will take a picture of the item (no box required) on the consumers’ doorstep and use Artificial Intelligence (AI) for product validation (Is it shoes or a tissue box?) which reduces fraud; grading (Can this be resold immediately or does it require additional inspection?), and to start the refund process.

- Use returns to augment sales. Now that the retailer has solved the inconvenience of returns and incorporated returns into their planning processes, they can focus on increasing sales through higher cart conversion, stronger sales against the competition without similar returns experience, and increasing long-term value (LTV). 73% of consumers said that a return policy has stopped them from buying an item from a retailer or brand, so consumers will likely change their buying behavior if free returns go away and/or are not replaced by a more convenient experience.

While the future of returns may sound more expensive for the retailers, the overwhelming value accrues to the retailer through selling more and contributing millions to the bottom line. Consumers do not always know what they want because they do not always know what is possible – consumers did not know they wanted Amazon Prime until Amazon built something that improved their experience (and helped Amazon sell more). Returns pickups is not a novel concept but the efficient execution of it is, so retailers must innovate and deliver the future of returns for the fundamental metrics and consumer satisfaction.

1 eCommerce – United States (Statista)

2 There’s a good chance that brand-new item you returned went to a landfill (Business Insider)

3 Best Buy’s new virtual shopping experience brings expert advice to your fingertips

Christian Piller

Christian PillerChristian is a Co-Founder and CCO of Pollen Technologies, Inc. where he is responsible for business development, fundraising, sales, and strategy. Christian brings 15+ years’ experience of supply chain execution, strategy, and digitalization from project44, Amazon, and Grainger.

He is a Lecturer at DePaul University’s Kellstadt Graduate School of Business and an Instructor for the University of Tennessee’s Executive Education for the Department of Homeland Security (DHS). He has been quoted in several publications, including Forbes, The Wall Street Journal, and Inbound Logistics.

Christian earned his bachelor’s from Purdue University. He and his wife, Michelle, live in Chicago.