What is the Current State of Reverse Logistics Software?

By Charles Rathmann, IFS

What is going on with reverse logistics software at manufacturing and product-centric companies in North America? According to multiple data sources, reverse logistics is becoming a more central part of the business model and is more important for revenue generation than ever before. But are companies making the investment in software to streamline the reverse logistics process so that it can be a profit center rather than a cost center?

We are witnessing an inexorable change in product-centric business models. Gone are the days when a product could be marketed with little to no thought to what happens after the initial sale. Global commerce has resulted in a world where products are commoditized, and downward price pressure limits revenue from product sales. The aftermarket is where the profits are. This in turn is driving a trend towards servitization.

This trend is a long time coming, given what has been happening in recent years with revenue from new product sales. According to a 2013 IDC Manufacturing Insights survey, just 12 percent of capital equipment manufacturers expected a substantial increase in equipment sales revenue over the next three years. Another 30 percent expected some increase, with 30 percent expecting no change and 27 percent expecting a decrease. In Europe, the Middle East and Africa (EMEA), just 15 percent of respondents expected equipment sales revenue to increase substantially compared to 9 percent in North America.

Aftermarket service may encompass a number of different business processes, including:

• Warranty management to track what equipment is and is not under warranty and what the warranty terms require.

• Contract management to operationalize customer-specific agreements and measure performance against terms.

• Field service to profitably manage technicians servicing equipment at the customer site.

• Subcontractor functionality to streamline bid letting, bid acceptance and work order management for third parties involved in servicing customers.

Reverse logistics software is a key component to servitization as parts, components and assemblies are returned for repair, refurbishment, recycling or disposal.

Reverse logistics in particular is challenging for companies experiencing servitization because:

• There is a high degree of diversity in terms of how different parts are treated. Software must formalize a value chain for everything from inventory cores that are refurbished to parts that are returned as defective or for break-fix repair. Even parts returned for disposal might be traced due to regulations on the end-of-life treatment of electronics.

• Customer-specific requirements can affect ownership of the part as it enters the reverse logistics supply chain and the extent to which repair work on the part may be tied to a revenue event or included in a contract.

• Returning inventory handled by subcontractors involved in servicing customer assets and must also be tracked as part of the reverse logistics supply chain. How does the subcontractor signal that the part is returning to inventory? Do they require a replacement part, or do they or the customer already have one in inventory? When do they get reimbursed for the part—when they notify the OEM it has been replaced, when they supply a tracking number indicating shipment, or when it is received back into inventory?

CURRENT ADOPTION RATE

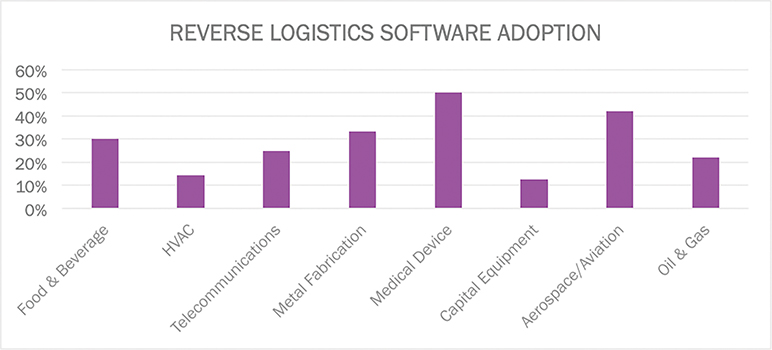

According to research conducted by IFS, adoption rates of reverse logistics software vary by industry. The early 2018 study reveals that these adoption rates break down along predictable lines, with perhaps a few surprises.

30 percent of food and beverage industries had adopted reverse logistics software. In this space, the returns process is mission critical because it involves applying credit to customer accounts and updating the product disposition. Usually, these products are removed from distribution because they are damaged, discontinued, expired or recalled. In some cases they may want to record root cause of returns and collect other actionable intelligence.

Discrete manufacturing disciplines often operate a depot repair environment in addition to the returns process, and inventory may be returned to the customer, be entered back into inventory, sold as reconditioned or be dispositioned in a number of other ways. It is no surprise that manufacturers of high-value, mission-critical systems in industries like medical device and aviation/aerospace product were most likely to have specific reverse logistics software systems in place. For each of these industries, traceability of the inventory is required for safety and regulatory purposes, adding a layer of complexity to the reverse logistics process.

Medical device manufacturers will need reverse logistics systems to facilitate compliance with, for instance Food and Drug Administration 21 CFR Part 11, which governs electronic records, electronic signatures and electronic submissions. Essentially, all work performed on a covered medical device must be logged in a register that accompanies the device.

Companies providing aftermarket support on aviation and aerospace assets will face various regulations depending on whether they are working on commercial or military aircraft. But commercial aircraft and assets will be covered by 14 C.F.R. 43.9 for any maintenance performed, and FFA Form 337 when a repair involves a major alteration to the aircraft. If they are removing life-limited parts from the aircraft, they must document the current life status of the part. They also must maintain records of any repairs—including those performed in a depot environment-for a year in the case of basic repairs and for the life of the aircraft in the case of major alterations.

The takeaway here is that companies in regulated industries must be prepared for serial traceability in their reverse logistics operation.

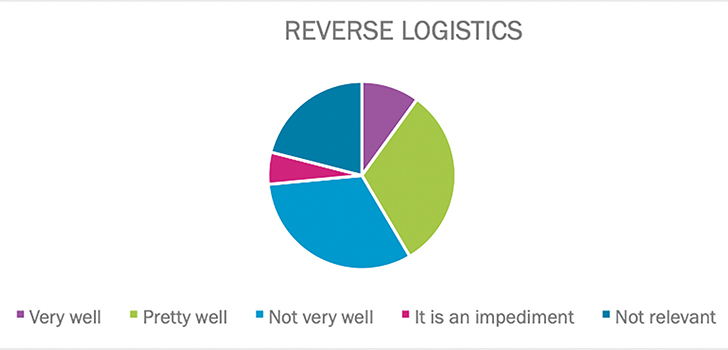

Only 14 percent of HVAC companies in the 2018 IFS study reported having implemented reverse logistics software, and another IFS study reveals that these and other companies with a footprint in construction trades have a documented need. Almost 80 percent of contractors in the study of HVAC, mechanical, plumbing and other trade contractors indicated reverse logistics was a relevant discipline in their business. Only 10 percent of respondents said their software handled reverse logistics “very well,” however, and more than 37 percent said their software was an impediment to successful reverse logistics processes.

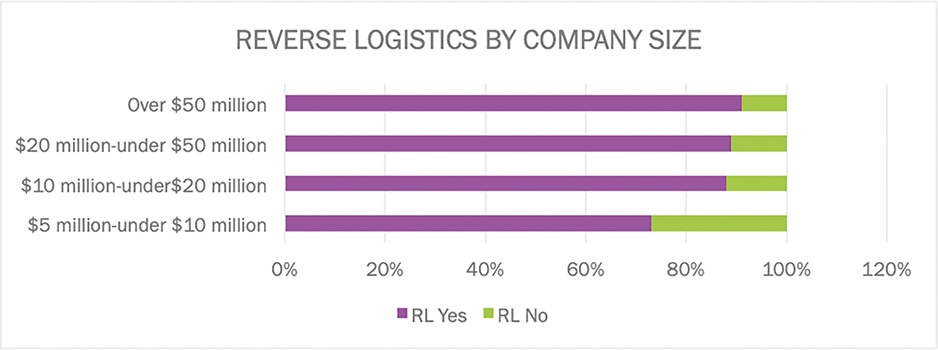

Respondent organizations did not have to be very large before reverse logistics became important to them. Companies between $5 million and $10 million in revenue were least likely to report involvement in reverse logistics at 73 percent. This is in contrast to 88 percent of companies between $10 million and $20 million, 89 percent of those between $20 million and $50 million and 90 percent of those over $50 million.

GAPS STILL EXIST

A survey conducted for IFS by WBR Research suggested that field service organizations still face substantial gaps when it comes to reverse logistics.

• 45 percent struggled with serial traceability and tracking of the location and status of parts during the reverse logistics process

• 42 percent had problems handing the return materials authorization (RMA) process

• 24 percent cited the component repair and overhaul process as a functional gap

• 23 percent said training and education of bench and repair technicians involved in diverse repair process on a broad spectrum of equipment was a challenge

• 22 percent struggled with:

o Managing third party contractors involved in the service process, including which contractors can receive a replacement part automatically and which have to send the part back before receiving a replacement

o Tracking the specific piece of equipment and customer site the part came from

• 18 percent had a hard time determining who owns a part once it is removed from a customer’s equipment

• 12 percent faced challenges with high volume receiving of parts for repair

CONCLUSION

Reverse logistics is a critical business discipline across multiple industries and across a broad spectrum of company sizes. Current trends towards product-oriented companies offering services to augment and differentiate their products means that these activities are more likely to be treated as a profit center as opposed to overhead. This means companies will be under increasing pressure to implement enterprise software that encompasses and streamlines steps in the reverse logistics value chain, not only to ensure profitable returns and depot repair, but to protect or enhance the customer experience and comply with regulation.

Charles Rathmann

Charles RathmannCharles Rathmann has more than 25 years of experience in business-to-business journalism, primary research, industrial product marketing, media relations and sales and business development. Rathmann holds a degree in journalism from the University of Wisconsin-Oshkosh and is based in IFS’s Brookfield, Wis. office.