Are Handset Refurbishment Companies Leaving Money on the Table When Reselling Phones?

By Stephen Manning, FutureDial Inc

Hard and soft costs of quality can impact resale values of phones being refurbished for the secondary market. Are handset refurbishment companies unintentionally leaving money on the table with each phone they resell in secondary markets? Hard and soft costs of quality can impact resale values of phones. In addition, mis-graded devices have a ripple effect and outsized impact on resale value and therefore on your overall business, such as reprocessing costs, lost revenue opportunity, and damage to brand image.

RECONDITIONED PHONES FUEL THE SECONDARY HANDSET MARKET - AND PRESENT CHALLENGES

Preowned smartphones are gaining a second life by the billions around the world, with a typical reconditioned phone now passing hands between 2 or more owners during its lifecycle. All this is due to the secondary market, powered by companies refurbishing preowned Android smartphones and iPhones. These refurbishment companies work hard to keep up with the ever-growing volume of phones being brought in through trade-in and buyback programs each year as part of the Reverse Logistics industry and the mobile device supply chain. The growth of 5G in the next few years is positioned to become a key driver for the secondary market and as a result, there will be many 3G and 4G handsets that people will replace with new models, allowing other consumers in secondary markets to utilize those older models.

Reconditioned mobile phones present challenges for these refurbishment companies. Issues such as the mis-grading of handset cosmetic condition for valuation, and inaccurately testing the functionality of devices can all lead to mispriced resale value ― in essence, refurbishment companies are leaving money on the table with each phone that they resell, because they did not have a true, accurate, verifiable resale value established for the devices.

COUNTING BOTH THE "HARD" AND "SOFT" COSTS OF QUALITY FOR HANDSET REFURBISHMENT COMPANIES

In handset refurbishing, “hard” and “soft” costs of quality in processing operations are recognized for their impact in bottom line profitability. The “hard costs of quality” are usually found in the efficiencies and throughput of an operations line, and cost-saving measures are often implemented to squeeze out more profitability. The “soft costs of quality” include the impact on resale value of inaccurately evaluated product, the costs of reprocessing devices, and the damage to customer perception of the company reputation and brand.

MEASURING SOFT COSTS: IMPLICATIONS ON BUSINESS DECISIONS

Quantifying the resale value loss requires calculating discrepancies in average prices between devices of different conditions. For example, the difference in resale value of an iPhone X (64GB) “A”-graded condition vs a “B”-graded condition is $24.00. For the same model device, a mis-graded “A” device versus a “C” device results in a $39.00 discrepancy. In reviewing the current slate of popular phones (including the iPhone X, XS, XR, 11, 8, and Samsung S9, S10, S21, and Note devices) the average discrepancies (which can be interpreted as potential loss) are listed below.

$20.65 (6.14%) - Average Loss for Mis-graded Devices* (“A”-grade vs. “B”-grade)

$18.23 (5.82%) - Average Loss for Mis-graded Devices* (“B”-grade vs. “C”-grade)

$38.88 (11.56%) - Average Loss for Mis-graded Devices* (“A”-grade vs. “C”-grade)

* (Average Price Discrepancy based on a sample of popular devices at press time, including iPhone X, XS, XR, 11, 8, and Samsung S9, S10, S21, and Note devices)

Mis-graded devices incur costs for reprocessing

In a hypothetical scenario, 30% - 40% of devices are mis-categorized. For the sake of simplicity, this model assumes half of the mis-graded devices are handsets that have been graded lower than their actual condition, while the other half are mis-graded as being in better than the actual condition. In the first case, the entity selling the devices has lost potential resale value (often the buyer won’t complain about receiving product that is actually of better quality than expected), while in the second case the buyer will return the device and complain about the unit being in worse than expected condition. In either situation, the device processor/seller loses the value differential for mis-graded product and in the case of returned product, the processor will then have to reprocess and incur additional costs of doing so.

An example illustrates the enormity of costs that are associated with mis-grading devices:

Suppose a refurbisher of handsets handles a batch of 200,000 iPhone X’s (64GB). Approximately 30% or 60,000 units would be mis-categorized. Assuming half of those mis-graded devices are favorable to the buyer: 30,000 iPhone X’s (64GB) as “C”-graded devices, but in reality is actually “A”-grade product. The economic fallout (lost opportunity for revenue) to the seller would be calculated at 30,000 units x $39.00 loss per device = $1,170,000.

Hidden Soft Costs:

- 6.14% Average Lost Value Per Device Across A-B Spectrum

- 11.56% Average Lost Value Per Device Across A-C Spectrum

- Average Price of Smartphone - $352.22

- 30% Bounce or Return Rate means reprocessing costs as well as poor customer satisfaction and company brand deprecation.

- $5.15 – Average cost of reprocessing a device

The inverse is also undesirable; if the processor/seller mis-categorizes the other half (30,000 units) of iPhone X’s (64GB) as “A”-grades when they are actually “C’-grades, the customer would likely return the units incurring reprocessing costs of $154,500. This is calculated by considering the average reprocessing cost between $4.80 to $5.50 = $5.15… So 30,000 units x $5.15 = $154,500.

This does not include the damage to the processor/seller’s reputation and brand image, the risk of carrying the inventory in a potentially volatile market for devices whose value may drop precipitously in a matter of days.

Therefore, when evaluating any new processes or possible improvements in the refurbishment company’s operation lines, it is important to account for overall business benefits. In addition to increased efficiency and throughput (the so called ‘hard’ cost savings measures), the impact on cost due to any increased accuracy must also be recognized.

LEAVINF MONEY ON THE TABLE WHEN RESELLING PHONES? AUTOMATION CAN HELP

An exciting trend in the refurbishment industry is the advent of automation in the form of software solutions and robotics that take the guesswork out of certifying the condition and functionality of handsets for determining their resale value in secondary markets.

Robotics and automation have been viewed in some circles as replacing people on the work floor, but in reality automation at the refurbishment center line operations helps workers to be far more productive, reduce waste, and produce better results for the company’s bottom line when the phones are resold in the markets.

Impact of Automation, by the Numbers:

- 98% Repeatability in device testing with Automation

- 50%-72% Typical Manual Repeatability Range

- 30% Reduction in Return (Bounce) Rate

- $352.22 Estimated Average Price of a Resold Smartphone (across grades A-C)

Automation helps refurbishment companies increase their grading and testing accuracy and look at data and analytics in a platform context, and this helps the decision-makers to utilize that data and insights from automation with their operational decision-making and purchasing and reselling, as well as leveraging it for other services and capabilities. So when automation is introduced into processing line operations in various ways, pricing trends and the residual value curves can be analyzed more accurately, and the purchasing and the product lifecycle all benefit.

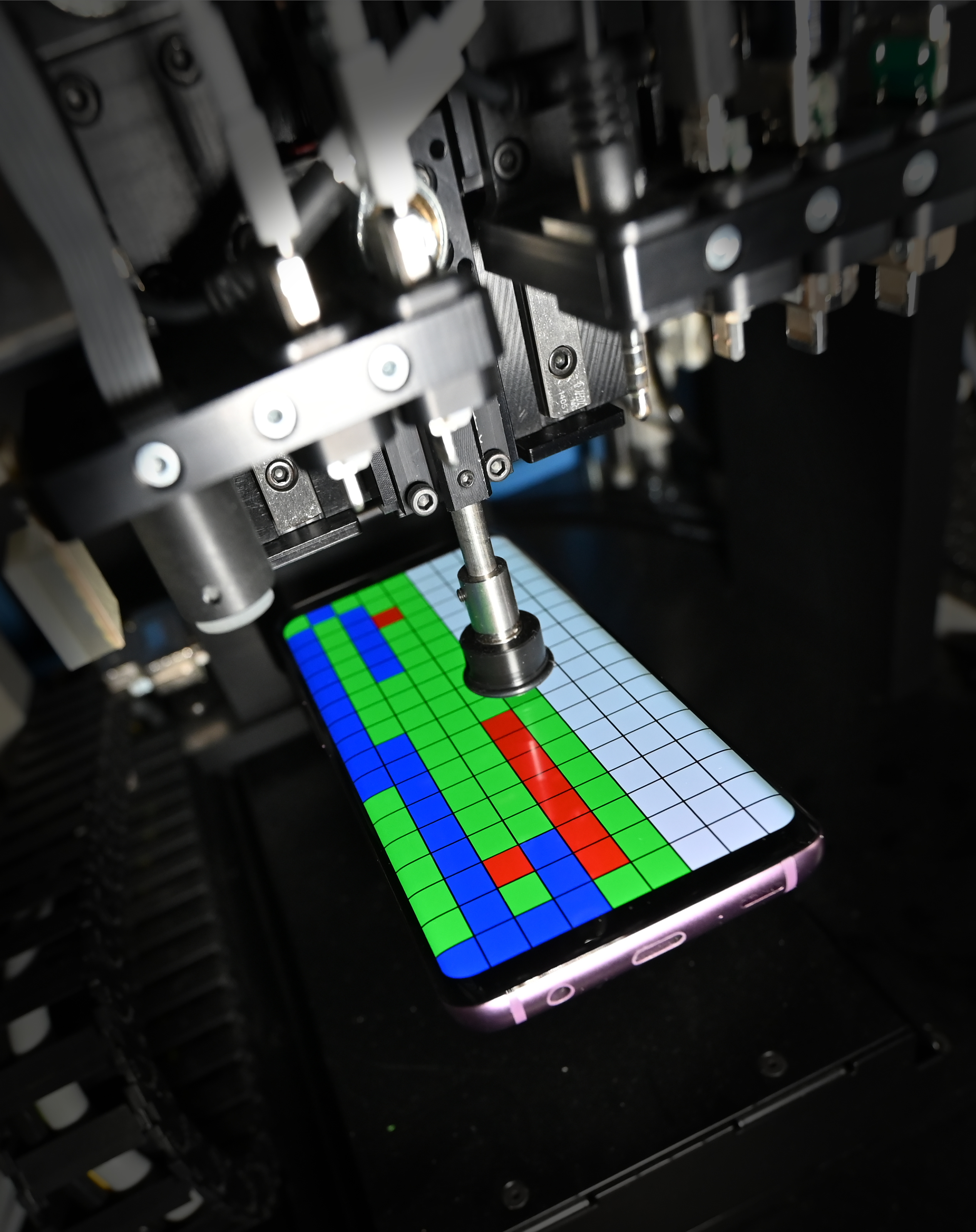

Robotic processing ensures consistency and accuracy in refurbished handset quality

CONCLUSION

When calculating total costs and benefits of automation processes that increase accuracy, it is important not to overlook the ‘soft’ cost factors for business impact. In our example, the ripple effect of mis-characterized devices has an outsized impact on resale value and therefore overall business: reprocessing costs, lost revenue opportunity, and damage to brand image.

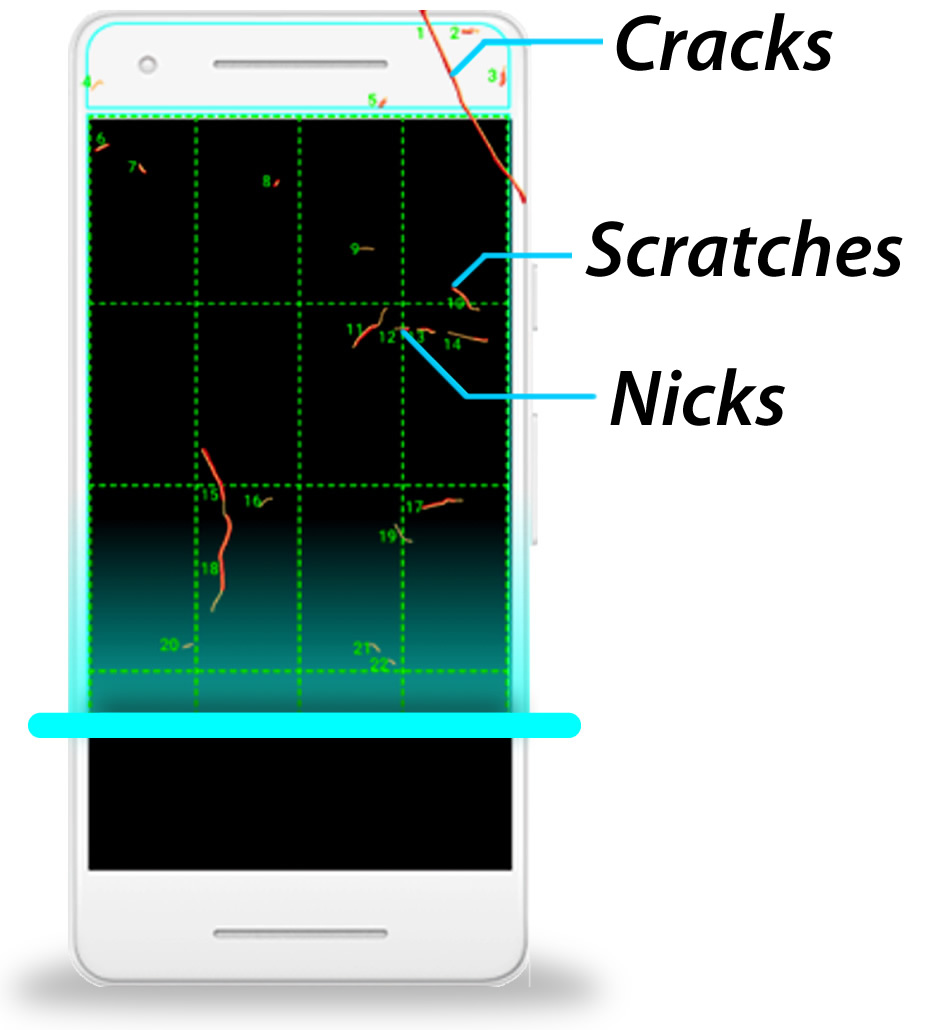

Robots and software can detect flaws more accurately than the human eye for more precise condition grading

Stephen Manning

Stephen ManningStephen leads the strategy and business development at FutureDial, Incorporated, the leading provider of device processing solutions for the mobile device reverse logistics supply chain. He oversees initiatives with customers such mobile device refurbishers, buy-back and trade-In companies, third-party logistics providers (3PLs), wireless carriers and mobile device manufacturers (OEMs).

Stephen is a senior level Information Technology executive with over 30 years of multinational experience in ecommerce, wireless, outsourcing, reverse logistics, operations, sales, marketing and finance. Prior to joining FutureDial, he served in several leading roles, including Chairman and CEO of Recellular Inc., President and CEO of CloudMSP, Sequel Inc, as well as Senior Vice President of Solectron Global Services, AT&T and other leading companies. Stephen received his BS in Economics and Finance from the University of Nebraska, and earned a CPA.