Tapping into the Powerful Financial Wins of the Circular Economy

By Richard Martin, Requis

There are many reasons why reverse logistics managers are interested in the circular economy. Many are in a B to C market, and they care because their customers care. Or perhaps they’re simply tuning in to the uptick in buzz around the term recently. In the end, however, we all want help the environment.

Whatever the reason they’re pursuing the topic, they’re often not aware that the circular economy represents a staggering economic opportunity that is waiting to be unlocked.

As supply chain strategist and circular economy advocate Deborah Dull said on a recent episode of our podcast, Supply Chain Next, “The businesses that are getting this right are saving billions of dollars.”

The Two Types of Enterprise “Output”

Before we dive into the numbers (and I promise you they’re exciting) I’d like to differentiate between the two main types of inventory carried by businesses:

a. Assets acquired and converted to product to be sold to customers.

b. Assets acquired and used in operational processes— the things we use while creating our products or administering our companies, but don’t sell to our customers.

In this article, we’re going to focus on the overall revenue potential of the second output.

Setting the Stage: Revenue Potential for the Disposition Market

One of the easiest ways to engage in the circular economy is to simply sell what your company no longer uses.

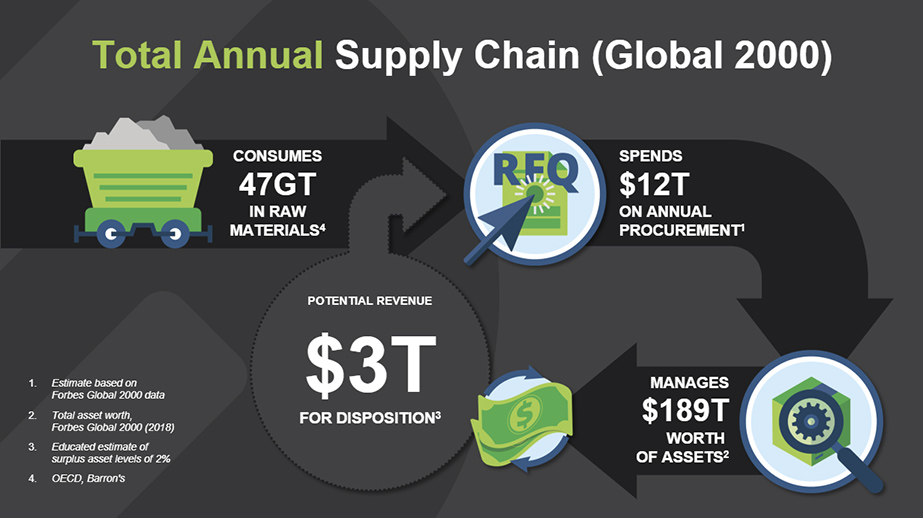

According to the Forbes Global 2000 report 2018, the top 2000 companies in the world are sitting on $189 trillion in assets ².

If enterprises liquidated just 2% of these assets, it could generate about $3.78 trillion ³. That’s a huge amount of free cash for the organization.

Where did I get the 2% number? While working with our clients in the oil and gas, mining and resources, and IT verticals, we’ve had hundreds of conversations about surplus assets.

2% is, in fact, a very conservative estimate of the amount of surplus assets companies have in warehouses and storage yards— much more conservative than what our clients have reported. And we haven’t even factored in the warehousing and maintenance cost savings once the assets are liquidated.

Fig. 1 – Total aggregate supply chain for the Global 2000.

But we shouldn’t get too stuck on the fact that this number is anecdotal— the truth is, the actual number doesn’t matter.

Because the aggregate asset collection for enterprises is so large, no matter what the exact number is, the impact will still be massive.

At some organizations the number will be higher, and at some a bit lower. Some companies don’t even know what the number is for them, because their asset records aren’t reliably tracked in a digital system. The point remains that having an active disposition program can yield financial benefits.

Using the Circular Economy to Take a Bite Out of Procurement Costs

Disposition is only the first step on the road to better sustainability and operational efficiency. Used and surplus assets can be leveraged to reduce procurement costs as well.

Based on the Forbes number and several sources for procurement spend percentages, we estimate that the Global 2000 spends about $12 trillion on procurement annually ¹.

The trillion-dollar question is: how much could be saved if organizations shopped for surplus, used, or refurbished assets before they looked at new?

Consequentially, how much could we move the needle on some of the environmental problems we’re faced with at the same time?

The Potential Environmental Benefit

According to estimates based on numbers from OECD and Barron’s, the Global 2000 consumes 47 gigatons of raw materials annually for raw materials extraction ⁴, ⁵. This could be reduced if enterprises were to simply start selling their surplus assets to each other.

The impact would be dramatic, especially considering we don’t have to invent new technologies or change any infrastructure. Let’s say it another way: we don’t have to make a major investment to see this happen.

Here’s how I see the effects playing out. As you saw above, Forbes says that the Global 2000 owned $189 trillion in assets as of 2018. That’s 52.5% of the world’s wealth (if we use Barron’s number for total global wealth at $360 T).

The OECD says that we all consume 90 gigatons of raw materials annually, with the Global 2000 consuming about 47 gigatons (if we use Barron’s number to calculate that the Global 2000 are responsible just over half).

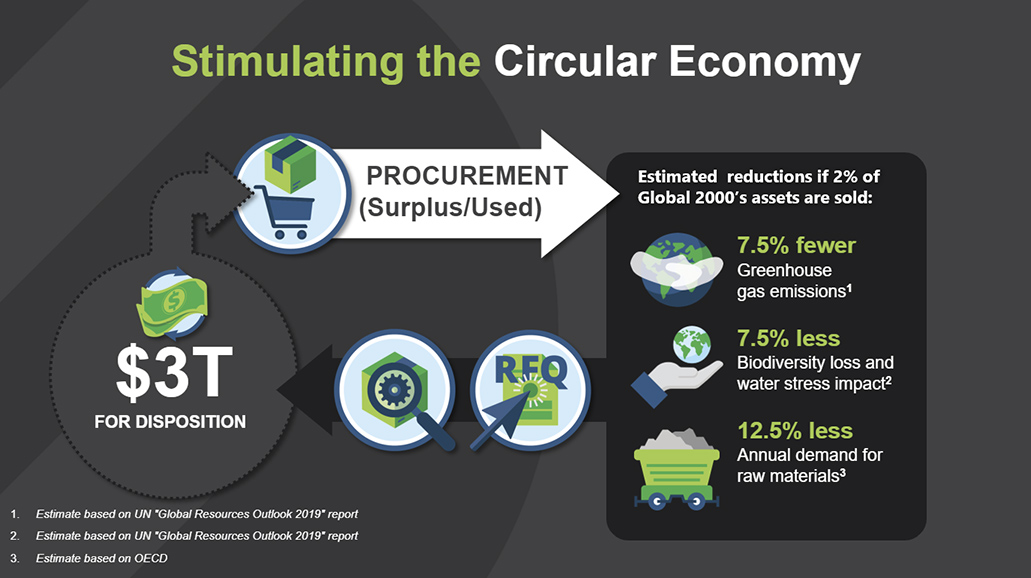

Fig 2 – Benefits for the environment if the Global 2000 started leveraging the circular economy.

According to the UN report “Global Resources Outlook 2019”, “Overall, the extraction and processing of natural resources accounts for more than 90% of global biodiversity loss and water stress impact and approximately half of global greenhouse gas emissions ⁶.”

Bringing it all together: If Global 2000 companies sold their 2% idle surplus to other buyers, that would instantly and easily reduce:

- Annual demand for raw materials by 12.5%

- Greenhouse gas emissions by more than 7.5%

- Biodiversity loss and water stress impacts by over 7.5%

Again, the exact numbers are a general estimate. The takeaway here is that a very small displacement in procurement, from new to used, has a massive positive impact on the environment.

Who’s Making Sustainability Work?

Let’s take a step back from the number crunching and take a look at the companies that are already seeing cost savings and/or other benefits by incorporating elements of sustainability into their supply chains.

While these companies have had to sink extra costs into refurbishment and/or redesigning products for reuse or recycling, they’ve still come out ahead:

More and more companies are seeing the business case for sustainability. A 2020 Gartner study says that 70% of business leaders intend to invest in the circular economy in the next 18 months ⁷.

Sustainability is More Than Just a Feel Good

Enterprises have a great opportunity to put the turmoil of COVID-19 to good use. While we’re redesigning our supply chains for greater resiliency, we can also factor in processes to enable faster disposition, and undertake product redesigns to enable more secondary use markets.

As so many companies have shown, these efficiencies can make for a more profitable, more likeable business.

References

- Forbes: “As a group, the Global 2000 accounts for $39.1 trillion in sales, $3.2 trillion in profit, $189 trillion in assets and $56.8 trillion in market value. All metrics are up double digits year-over-year, with profits up an impressive 28%.” https://www.forbes.com/sites/forbespr/2018/06/06/forbes-releases-16th-annual-global-2000-ranking-of-the-worlds-largest-public-companies/#7ff5442a12a0. We’ve taken gross expenses - Sales/Rev - Profit + $36T and estimated supply chain costs to be conservative 1/3 of gross costs. Additionally, “External purchasing is the largest single expense category for most firms, averaging 43% of total costs (see Figure 1)” https://www.bain.com/insights/unearthing-hidden-treasure-of-procurement/. … but other organizations have given higher or lower percentages. We’ve used a conservative average.

- Forbes says that the Global 2000 owned $189 trillion in assets as of 2018: https://www.forbes.com/sites/forbespr/2018/06/06/forbes-releases-16th-annual-global-2000-ranking-of-the-worlds-largest-public-companies/#7ff5442a12a0.

- The 2% is anecdotal, but we use the same $189 trillion figure as in item 2, above.

- The OECD says that, as a global civilization, we all consume 90 gigatons of raw materials annually: https://www.oecd.org/environment/raw-materials-use-to-double-by-2060-with-severe-environmental-consequences.htm We’ve allocated 52.5% to the Global 2000 based on the global wealth number from Barron’s, below.

- Barron’s says total global wealth was $360 T in 2018: https://www.barrons.com/articles/global-wealth-grows-2-6-to-us-360-trillion-led-by-u-s-and-china-01571681689. The 189 Trillion from the Global 2000 accounts for 52.5% of this. We use 52.5% as a benchmark number when calculating the environmental impact of the Global 2000.

- UN report: Global Resources Outlook 2019: “Overall, the extraction and processing of natural resources accounts for more than 90% of global biodiversity loss and water stress impacts and approximately half of global greenhouse gas emissions.” - https://wedocs.unep.org/handle/20.500.11822/27518.

- Gartner: Seventy percent of supply chain leaders are planning to invest in the circular economy in the next 18 months: https://www.scmr.com/article/investment_in_the_circular_economy_is_gaining_traction_with_supply_chain_le.

Richard Martin

Richard MartinRichard Martin is a 25-year veteran of the high-tech industry working for technology leaders such as VMware (NYSE: VMWARE), Nortel (NYSE: NT), Bay Networks (NYSE: BAY), 3Com (NYSE: HPQ), Chipcom (NASDAQ: CHPM), Memotec (NASDAQ: CMTL), Bell Northern Research (NYSE: NT) and IBM (NYSE: IBM). He has a proven track record for providing strategic and operational leadership in research and development, product management, marketing, business development, sales, channel management and operations. Richard is CEO of Requis.