Can Online Returns Boost Your Profitability This Holiday Season?

By Morgan Mullis, Chainalytics

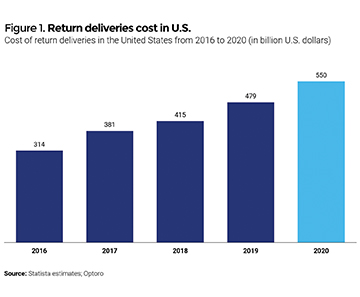

Record-setting online holiday sales forecasts combined with new try-before-you-buy business models are expected to propel upwards of $550 billion in returns this year. To minimize the impact on the supply chain and boost overall profitability, companies need to assess their reverse logistics network for opportunities to increase capacity, improve inventory recirculation, and cultivate customer loyalty.

The retail industry is bracing for a season of uncertainty as Chinese tariffs intended to amend trade imbalances have had the adverse effect. GDP has already dropped, signaling an inevitable downturn on the horizon. Slow growth is now forecasted beyond 2020, and many retailers are already feeling the implications. So far this year, retailers in the U.S. and UK have shuttered 8,579 stores, with this number projected to reach 12,000 by year’s end.1

For now, online retail sales seem to be immune to this downturn. In fact, this holiday season forecasts strong growth for e-commerce. The National Retail Federation projects online retail sales may exceed $167 billion in 2019, an increase of 14% from last year. This is substantial when you consider the retail industry as a whole is hoping for a mere 3.8% uptick.2

However, these online sales have an added supply chain burden and subsequent cost of business: high return rates. Now more than ever, returns are becoming the norm for online shopping. Nearly a quarter of all businesses plan to adopt some form of “try-before-you-buy” business model – similar to those exemplified by companies like Stitch Fix or Warby Parker.3 In these new models, returns are a foundation of the customer experience. It is simply expected that an order will involve both an outbound and reverse shipment.

Can your current supply chain absorb this one-to-one ratio should order-to-return forecasts materialize?

Consumers are enamored with this business model, trading their shopping carts for cardboard boxes containing items they browse and select from the comfort of their living room. But this added convenience creates increased pressure on an already overloaded holiday shipping network. Brightpearl calls it the “returns tsunami of retail,” and for good reason. In the U.S. alone, Happy Returns forecasts that returns will top $550 billion this year4 – a 75% increase over four years (see Figure 1 on page 21).5

In an efficient supply chain, the “return and repair” process can account for 10% of supply chain costs, but in an inefficient one, costs can spike upwards of 30%.6 Running an online channel without understanding all of the supporting costs can hurt your overall business.

When was the last time you assessed the profitability of your online reverse logistics operations?

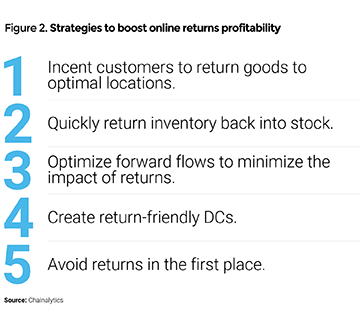

To boost profitability of your e-commerce channel and reduce the impact of returns on overall costs, you should consider taking these steps:

1. Incent customers to return goods to optimal locations. The “buy anywhere, return anywhere” mantra of omnichannel retail has introduced many inventory and restocking complexities. Customers often return unwanted gifts to suboptimal locations, moving the product further away from its potential next customer. Incentivizing customers to return items to optimal locations enables companies to reduce logistics costs and strengthen the likelihood of moving that merchandise to a second buyer at the original price.

Creating a physical location where customers can return unpackaged items for immediate refunds can also cultivate customer loyalty. These physical locations are convenient for your customer, but also allow your supply chain tighter control of returns and quicker access to inventory. Amazon has enlisted the help of Kohl’s 1,100 locations to accept returns at its physical stores. Nordstrom’s Local are convenient service hubs that allow customers to pick up, alter, or return online orders. Start-up Happy Returns now has more than 700 locations in malls and college campuses where customers can return items purchased from online companies like Draper James who don’t have a physical presence. Smaller retailers can capitalize on this supply chain infrastructure to aggregate returns and costs with other companies.

2. Quickly return inventory back into stock. According to Shopify research, it takes 25% of online retailers nearly two weeks to cycle returned items back into inventory.7 The longer this window, the greater the probability the item will not sell during the holiday season. Manufacturers should entice retailers to liquidate returned items rather than route them back through the supply chain. Best Buy, for example, accepts returns at retail locations and lists these open-box products online on the same day. Third party logistics provider Shipbob intakes a client’s return, sorts it into resaleable or disposable inventory, and then uses it to fill pending orders directly from their warehouse. One of Chainalytics’ clients reduced returns expense by 22% and significantly reduced delivery times in part by holding inventory regionally for redelivery, rather than returning to its original stocking location.

3. Optimize forward flows to minimize the impact of returns. Getting goods to the customer over the holiday rush has never been a trivial task. And this year will prove even more difficult. With Thanksgiving falling on November 28, the holiday shipping season is condensed to only three weeks. This means that shippers will have more product to deliver than ever and one less week to do it. The consumer demand for faster delivery will compound this pressure. To account for the capacity you’ll need for returns, you should increase the efficiency of fulfilling customer orders by:

- Forecasting freight capacity now. Now is the time to assess your logistics network to ensure you have the people and processes in place to handle the holiday rush. Take a hard look at how much freight capacity you’ll need and when you’ll need it. It’s the perfect time to build a forecast if you don’t already have one in place. Your end result should be a forecast plan that translates all the way through to the carrier, including the number of trucks required as well as the number of partials. You’ll need firm transportation plans and carrier commitments completed before Thanksgiving to create sufficient holiday capacity.

- Plan for last mile delivery. Everyone will need last mile delivery capacity this holiday season. Have you created enough goodwill with your carriers this year to receive it? Ask your carriers if they are prepared to meet their commitments and your projected volumes. If you’ve waited until now to have this conversation, it may be too late. In some cases, the best solution might be to eliminate the last mile altogether. Incenting online customers to pick up in stores will offer delivery flexibility while allowing you to free up last mile capacity.

4. Create return-friendly DCs. Many companies currently see returns as a minor distraction, not an everyday cost of doing business. This will be the year you feel the impact whether you are prepared for the cost and service implications or not. Reverse flow logistics costs are going to rise sharply, and companies need to prepare their reverse logistics networks with the same optimization capabilities they use for forward moves. Substantial savings can be generated for companies that optimize reverse-flow inventory, fulfillment and transportation operations. This may be an opportunity to bring in a third party who already has these capabilities. One Chainalytics client reduced logistics expense 60% by outsourcing to a third party with advanced supply chain operations.

5. Avoid returns in the first place. Zappos has used returns as a way to grow customer loyalty and profitability. Amazon has closed the accounts of clients with too frequent returns. Most companies fall somewhere in between these two extremes. In general, customers return products for three basic reasons: the product failed, didn’t meet expectations, or wasn’t user intuitive.

Determining the root causes of returns and capturing this data can reveal exact problems in need of resolution. Products that underperform can be evaluated to determine the root cause of failure. If the problem is within the supply chain, it can be corrected. If the product is poorly designed, merchants can replace faulty products with comparable items. If the problem stems from mismatched customer expectations, companies can choose to enhance online visuals and real customer reviews to better educate customers and beef up product support. Encourage customers to share their complaints so you can learn how to better serve customers. This returns data is free market research with great insight into customer preferences and behaviors.

One recent high-tech client of Chainalytics had “no trouble found” product return rates in excess of 50%. Its customer would order a product online, fail to get it working properly, and return it as faulty outside the buyer remorse window. When shipped back to the warehouse, the robust inspection process determined the product was in perfect working condition. Reducing these “false fails” can be addressed by equipping customer care and retail support with the proper troubleshooting tools and techniques to confidently resolve the customer’s issue. In this instance, equipping local technical support centers with software reflash and diagnostic tools as well as enhancing customer care training resulted in a 48% reduction of warranty returns and a 12% reduction in “no trouble found” returns.

The 2019 holiday season promises to be a challenging one, but it is manageable if you have the right return strategy and your e-commerce operations are fully optimized. Now is the time to assess how capable your current reverse logistics operation is to handle the additional demands of this season while looking for avenues to increase profitability and capacity. With careful tracking and planning, your reverse logistics operation can improve your customer experience while minimizing the overall impact on your supply chain.

1 https://coresight.com/research/weekly-us-and-uk-store-openings-and-closures-tracker-2019-week-40/

2 https://nrf.com/media-center/press-releases/nrf-forecasts-holiday-sales-will-grow-between-38-and-42-percent

3 https://info.brightpearl.com/returns-tsunami-for-retail

4 https://see.narvar.com/rs/249-TEC-877/images/Narvar_Consumer_Survey_Returns_June2017.pdf and https://www.shopify.com/enterprise/ecommerce-returns

5 https://www.statista.com/statistics/871365/reverse-logistics-cost-united-states/

6 http://www.rlmagazine.com/RLMagazine_10thEdition.pdf

7 https://www.shopify.com/blog/return-policy

Morgan Mullis

Morgan MullisMorgan Mullis is a Director at supply chain consulting firm Chainalytics where he focuses on helping clients achieve long-term value from strategic and transformational efforts, leveraging data and analytics to drive actionable results. He specializes in the areas of logistics operations, reverse logistics, and supply chain network design.