Reverse logistics has long been a secret society of open boxes and overstocked inventory. As the stepchild of the logistics world, there has been little information available about best practices, and even fewer insights into the successes and failures of other retailers. But over the last few years, the rise in ecommerce and subsequent rise in returns has increased the visibility of the supply chain’s inner workings, thrusting reverse logistics squarely into the spotlight.

A year ago, Liquidity Services decided that it was time to benchmark reverse logistics practices across retailers. We wanted to understand how retailers were challenged in their day-to-day operations: Where did retailers struggle the most? How could they accelerate success?

We partnered with an independent firm to survey more than 100 top retailers. We asked important questions like:

- How were retailers currently handling returns management and reverse logistics, and where did opportunities lie for rapid improvement?

- Which processes and technologies could be optimized to increase recovery and improve reverse logistics success?

- What gaps existed in their reverse logistics and returns management procedures, and what needed to be put in place to increase efficiency and meet customer demand?

Some of our results were predictable…some were surprising. Read on to learn how your peers are managing reverse logistics challenges, and what their goals are. To download the full study, visit Recovery & Efficiency: Are Retailers Poised for Reverse Logistics Success? - Liquidity Services.

Who Participated in the Study?

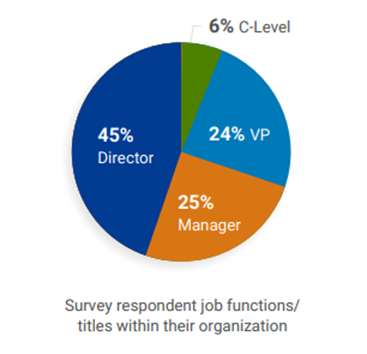

Over 100 senior leaders from Fortune 1000 retail organizations, representing a wide variety of product categories, completed this benchmarking survey. Fully 75% were director-level or above. As expected, the majority were both brick-and-mortar and online. About 15% were ecommerce-only retailers.

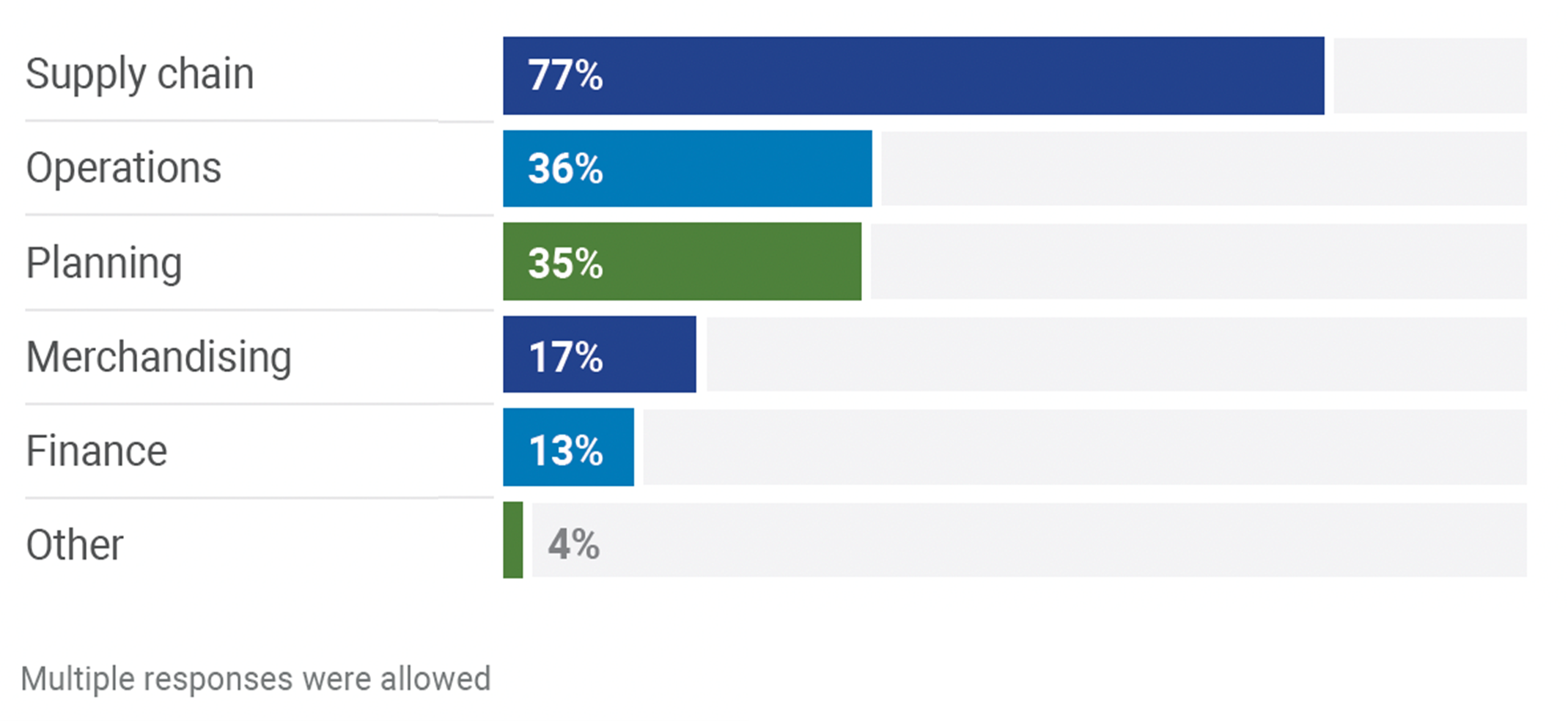

Returns Management: Who’s in Charge?

Over 60% used multiple departments to manage returns. On average, two departments were involved, but some retailers had up to five departments involved.

Multiple departments create many challenges -- and opportunities. Organizationally, when you have several departments with different processes, it tends to create silos. Every department has its own system, which can be difficult for data processing and information transfer. There are lots of cooks in the kitchen.

On the positive side, it creates opportunities for reverse logistics to shine. By synchronizing and optimizing processes across various departments and creating the systems to support them, the reverse logistics director can significantly slash returns processing costs, improve velocity, and become a corporate hero.

The Ins and Outs of Dispositioning Strategy

An area that we especially wanted to better understand was disposition strategy, whose role is often undervalued. Dispositioning your return is usually the most important touch point in the entire returns process and is a major source of labor costs.

More importantly, the success of your downstream recommerce activities is dependent upon your disposition strategy. How you disposition your inventory, how you sort it, and what information you capture will dictate what you do downstream with your product. If done right, this can result in dramatic improvements.

The journey of returns is notorious for taking multiple hops and touches: Product comes from your store, goes to a DC or third-party vendor, and how it is dispositioned after that becomes the major touch point.

Not all hops and touches add value. If you’re moving inventory from one place to another, ask yourself: Is it really adding value?

Your disposition strategy is critical. A significant amount of time is spent evaluating customer returns: Identifying them, determining what shape they’re in, what their value is, and deciding what to do with them. Frequently, we uncover disposition plans that were created long ago and forgotten about or were developed without input from the recommerce side of the house—without which, your process will be inefficient, guaranteed. Disposition plans need to be regularly refreshed. Improving your disposition strategy virtually always leads to higher recovery.

In our study, we learned that most retailers had multiple returns dispositions – on average, three. As expected, RTV was the most customary practice, with refurbishment a distant second. Fully 23% donated product, which is potentially a source of lost revenue.

Improving Efficiency: Where the Rubber Meets the Racking System

Anecdotally, we hear frequent laments about the need to improve efficiency. We decided to look at six parameters: labor costs, cycle times, disposition accuracy, transport costs, storage costs, and data and reporting—the latter of which proved to be the area that retailers felt was most lacking. Only 22% rated their data analytics as satisfactory, with many expressing a need to obtain one version of the truth.

A whopping 49% ranked their efficiency as only moderate, and another 17% admitted to being completely inefficient. Clearly, our industry has a problem, and most practitioners are painfully aware of it.

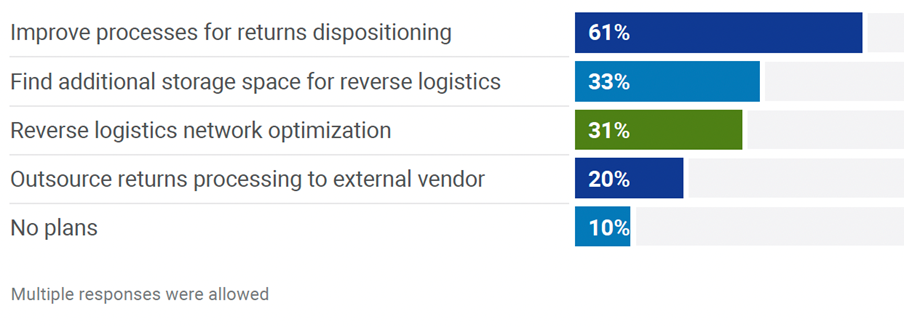

Given that efficiency was an obvious issue, we wanted to hear about retailers’ plans to improve it. Over 60% identified returns dispositioning as the key area for improvement, which is a smart decision. About a third needed more space, and another third planned to optimize their networks.

Given that efficiency was an obvious issue, we wanted to hear about retailers’ plans to improve it. Over 60% identified returns dispositioning as the key area for improvement, which is a smart decision. About a third needed more space, and another third planned to optimize their networks.

Network optimization is crucial, especially for products that are heavy and bulky. If you’re incurring transportation costs, a great deal of recommerce value is lost along the way. Sometimes using a third party is more efficient than doing it yourself, particularly for ecommerce-only retailers.

Network optimization is crucial, especially for products that are heavy and bulky. If you’re incurring transportation costs, a great deal of recommerce value is lost along the way. Sometimes using a third party is more efficient than doing it yourself, particularly for ecommerce-only retailers.

About 20% planned to outsource returns processing to an external vendor. Only 10% had no plans to improve.

Recommerce Challenges: A Surprise

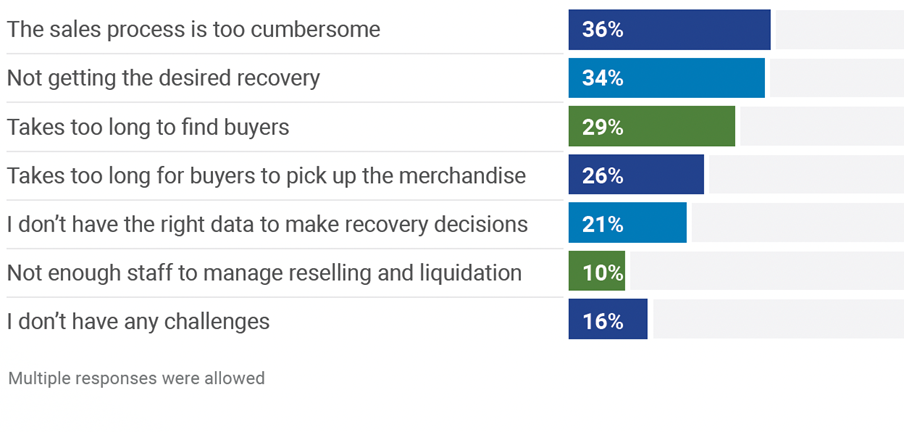

When we asked about challenges involved in reselling or liquidating product on the secondary market, over 60% reported at least one issue with their current sales process. Issues with the sales process was the #1 answer. Surprisingly, it was not recovery. Retailers said the sales process was cumbersome: It took too long to find buyers and for those buyers to pick up merchandise.

Historically, this process has been multi-faceted and inefficient: the retailer accumulates returns, then returns are put on a trailer, and the retailer must now find buyers, usually from a pre-approved slate. The retailer then emails buyers with a list of products, waits to gather responses, compares those responses, makes counter offers, and negotiates final pricing.

More than recovery, it is the process itself that kills your efficiency. It takes multiple touches that can often be reduced or eliminated entirely with technology.

Maximizing Recovery: How and When

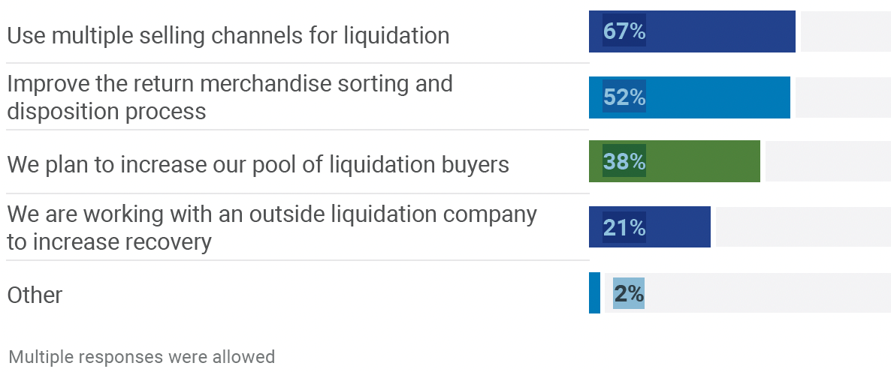

We also asked: What are your plans to improve your recovery process moving forward? Two-thirds planned to use multiple selling channels, half to improve sorting and disposition, 38% planned to find more buyers, and 21% worked with an outside liquidator.

Using multiple selling channels today is key. Retailers want to capture more value. The easiest way to do that is with pristine product that can go back into your own retail channels. Beyond that, you may have open-box product with no other faults other than packaging damage, or perhaps it’s missing some accessories but still has high value. You can sell it on eBay, Amazon and other third-party marketplaces even in that condition. Outside service providers can help with that.

It is important to recognize that the secondary market has several distinct kinds of buyers and several distinct types of marketplaces and channels. For example, you could sell in smaller lot sizes to B2B buyers using auction marketplaces. This strategy reaches small- to medium-sized business buyers who tend to buy pallets. You can sell by the truckload to large, professional B2B buyers who will re-sort your product and sell to their small business buyers who then sell to the end consumer. You can sell to consumers in single units online with curbside pickup, or to BIN stores or discount stores.

Each of these channels attracts different buyers. Understanding each type--how they buy, what they buy, and when they buy-- is an art and a science. You probably know your primary customers intimately. But how well do you know your secondary buyers? If you don’t have this specialized knowledge, it is important to work with someone who does.

When to Outsource

When to Outsource

What criteria should retailers consider when determining which processes to keep in-house or outsource? That depends on your in-house capabilities, goals, and type of product. Start by looking at what we call the Total Recovery Value framework. In most situations, the two easiest areas to outsource are transportation and recommerce. It’s just not where your focus is.

Look at warehousing and processing capabilities. What’s your in-house expertise? If it’s lacking, it might be more cost-effective to outsource. It also depends on what type of retailer you are. If you’re ecommerce only, it may be easier to use a third-party provider vs. developing your own systems. If you have scale and you have a huge distribution network already, in-house is better.

Look at your entire TRV process and your entire reverse logistics cycle. Benchmark your costs and recovery against other retailers. Because of silos or multiple departments, you may be focusing on one area without looking at the others. If you look holistically at your operation, this will drive the right decisions for you. Reverse logistics is an operational challenge but it’s also a leadership challenge. Companies who succeed break the silos and work together across other functions. Build a culture of continuous improvement and you will succeed.

Robyn Federman is a senior demand generation manager at Liquidity Services, Inc. (NASDAQ: LQDT), where she develops marketing and key account programs to support the growth of the retail division. She has directed marketing initiatives for a variety of business-to-business agencies and corporations for more than 25 years. She holds an MS in journalism from the University of Kansas and an MS in sociology from the University of Chicago.