Today, end-of-life management of electronics typically follows one of several pathways, including landfilling, shredding, hand disassembly, or exporting.

According to the latest figures from the U.S. EPA, just 38.5% of electronics are recycled each year, meaning the majority of end-of-life devices are disposed of by other means, such as landfilling or combustion.1 The agency doesn't currently track landfilling or combustion of ewaste, but back in 2009, the agency estimated that of the 75% of devices that weren't recycled, the remainder were "disposed of primarily in landfills, where the precious metals cannot be recovered."2

That presents a number of problems - beyond the lost value of the materials, landfilling brings the potential for toxic materials to be released into the environment.

These possible harms are widely recognized but are less widely addressed, due to a lack of environmental enforcement and, on a wider scale, the difficult economics of properly recycling electronics.

For the material that is collected for recycling, roughly 5% of it is shredded.3 This brings its own complications: Shredders tend to require a large investment and substantial maintenance, even while the output stream brings in a low value. Often, the economics revolve around the recycling company being paid to process the material rather than having the output commodities cover the cost.

Another smaller portion is disassembled by hand, a labor-intensive practice that relies on a few key factors for it to pencil out. Either the targeted device must have a high component value that justifies the additional labor, or the customer has paid the recycling company to manage it in that way.

Finally, a portion of the U.S. electronics stream is not processed domestically at all, but rather exported overseas. Estimates of e-waste exports vary widely; over the years, sources have put this portion at 10-40%4, or as much as 80% or more5 of collected electronics. This is a quick and relatively easy management method for the U.S. recycling company doing the exporting, but it can cause a slew of problems overseas - there have been numerous high-profile examples of U.S. electronics ending up in less-wealthy countries and creating garbage that those countries have to deal with. Thus, exporting e-waste has been criticized and increasingly regulated in recent years.

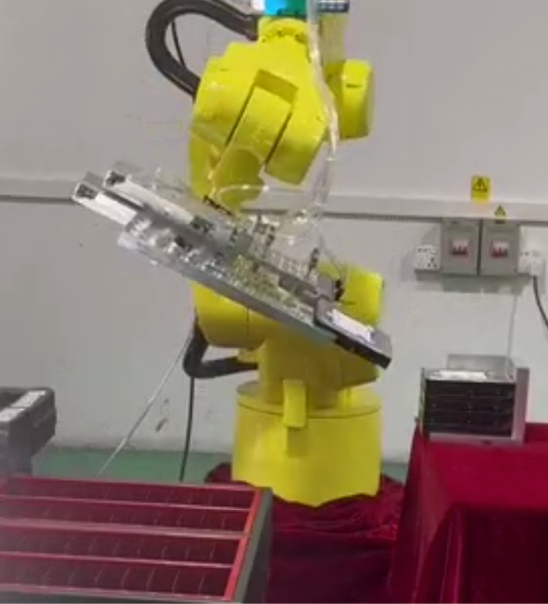

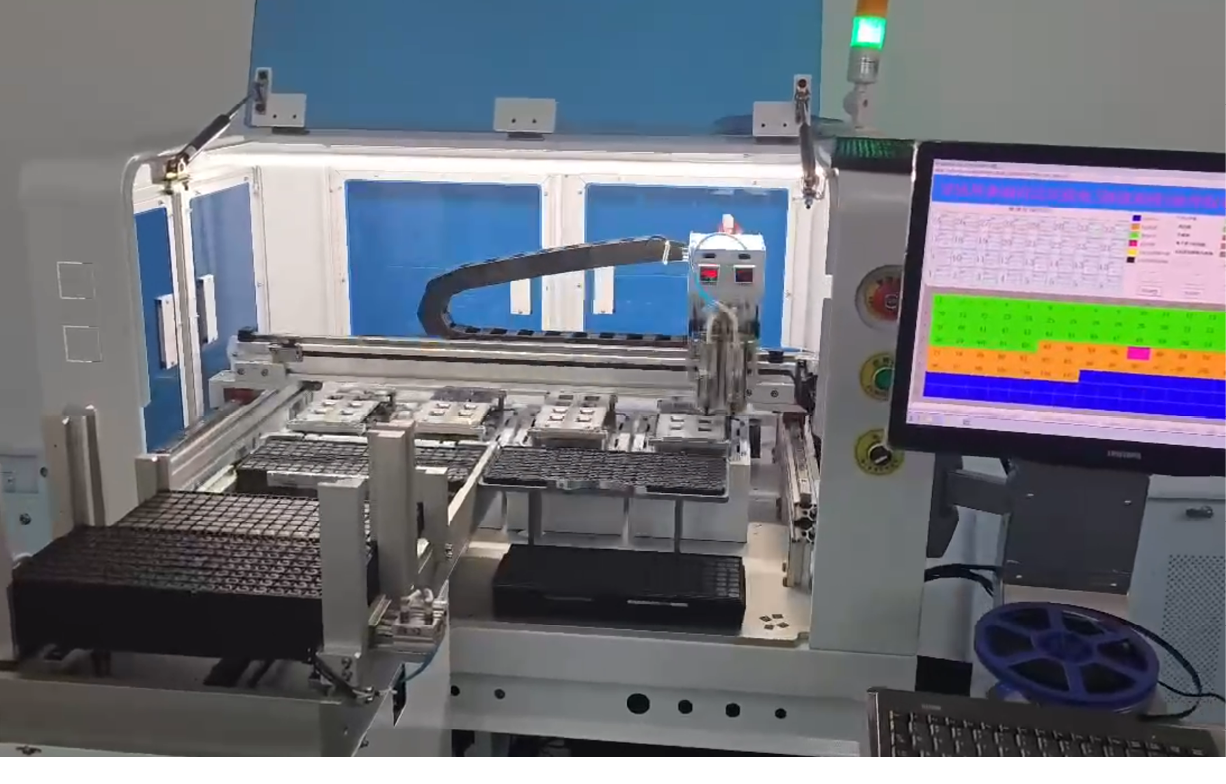

Now, there is a new way to process end-of-life electronics that addresses many of the shortcomings or drawbacks of the typical management methods: Robotic disassembly of devices.

At Toyoshima, we have been promoting robotic disassembly for three years in multiple recycling industry trade shows. We feel there are many advantages in robotic disassembly, and whenpaired with artificial intelligence systems, this technology will ultimately revolutionize e-waste recovery.

Unlocking greater value in the device stream

The end-of-life electronics stream typically generates five material streams that can become valuable commodities: Plastic, batteries, printed circuit boards, metals and, more recently, chips.

Plastic makes up an average of 20% of the weight of the typical e-waste stream, and current methods of plastics recovery from electronics provide subpar results.6 These e-plastics are often shredded and, due to current technology limitations, often only a small portion of the shredded stream is ultimately recycled into new plastic products.

But robotic disassembly changes this equation. Robotic disassembly provides a way to recover as much as 98% of the plastic in a given device, and it generates a clean stream of plastic.

Where a shredded mixed acrylonitrile butadiene styrene (ABS) product might fetch $0.1 per pound, a pure single-type recycled ABS resin can go for up to $0.25 per pound. Additionally, because it's a cleaner and pure stream, the plastic can go into a new product with less processing, avoiding a double melting process, for example.

This type of advanced plastic recovery is an important tool in helping the U.S. reach the 50% plastic recycling goal the U.S. EPA has set for 20307.

Batteries are another area robotics can improve electronics recycling. Currently, general practices involve pulling the batteries out by hand, a labor-intensive practice that can become costly given the number of batteries entering the stream. Robotic removal can provide a costeffective solution that also improves worker safety.

For many electronics processors, the printed circuit board is among the highest-value portions of the electronics stream. These boards can be recovered through hand dismantling or shredding. Sending these boards to a smelter produces valuable metals such as copper, gold, silver, platinum, aluminum and other precious metals.

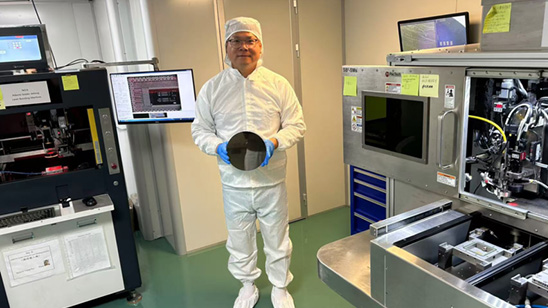

Shredding the boards creates some amount of yield loss because some portion of the metals won't be properly sorted after shredding. In fact, there is an inside joke in the recycling industry, that a company will spend a million to shred something, and two million trying to sort it back into usable streams. Additionally, up to 10% of the gold in the metal stream may be lost to vaporization during the shredding process. Some smelters are better at harvesting gold without this yield loss - facilities in Japan, for instance, often don't face this problem because they use smelting machinery that doesn't require material to be shredded first. But U.S. smelters typically will be processing shredded material.

On the other hand, if a robot disassembles the device, the recycler will be left with a clean, intact circuit board, which retains the board's full value.

Other metals in devices can also benefit from robotic sortation. Components such as heat sinks and electric power supplies are often recovered and shredded into a mixed metals stream.

Recyclers may get roughly 85% of the value back from the mixed stream, but the clean stream of intact components recovered through robotic disassembly can improve that to 98%. Robotic sensors can also help to identify which metals are which, allowing the recycler to maximize recovery - for example, if aluminum and copper are mixed and then smelted at copper-smelting temperatures, aluminum won't be recovered. But if the metals are identified and sorted out beforehand, each stream can be smelted separately for higher value recovery.

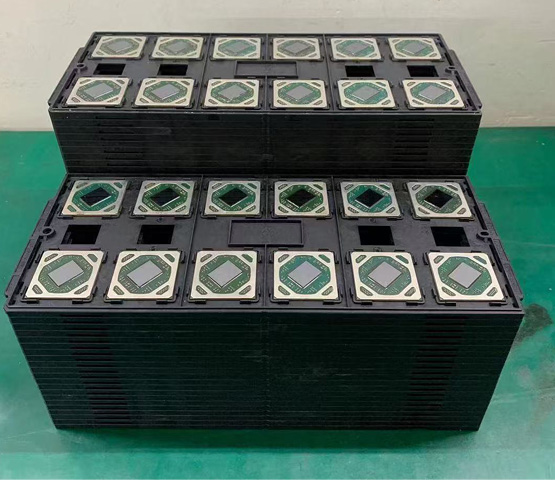

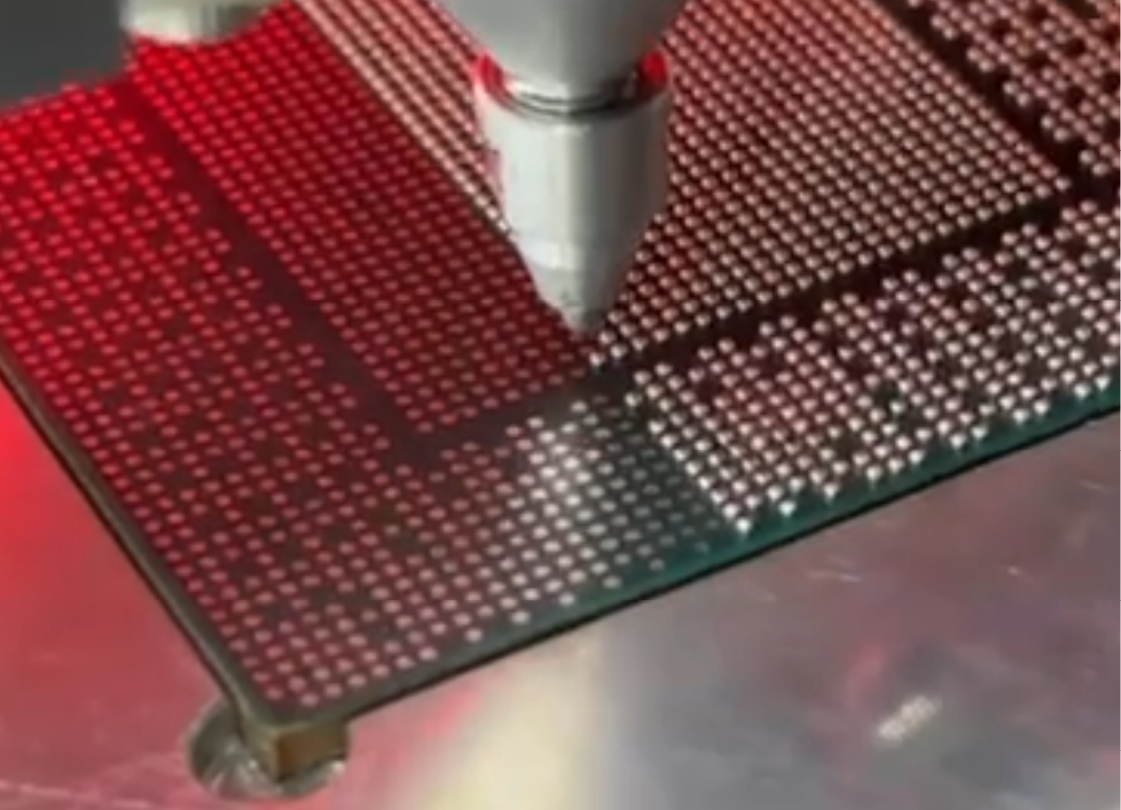

Finally, chip harvesting has become a hot topic within the electronics recycling space, as chips have taken on an outsized role in computing due to their importance in the data center and artificial intelligence space. This has been a major activity in Malaysia and China for some time.

I first started to promote the idea of chip harvesting in the U.S. seven years ago, and back then, not many companies took it seriously. But now, many of the major electronics processors have departments dedicated to chip harvesting.

Shredding the chips returns no value, while robotic disassembly can recover the intact chip for resale. It depends on the type of chip, as some chip values are too low to even make robotic disassembly pencil out, but certain types can be worth the cost.

Examples of specific applications

At Toyoshima, we've employed our robotic disassembly equipment to dismantle devices such as Chromebooks and routers, but it has many additional applications. Processing of almost any device type in large quantities can benefit from this technology.

Currently, in Malaysia and China, the chip harvesting practice is heavily manual-sortation dependent. There are more than 200,000 workers performing e-waste and chip harvesting at all times in these countries.8 Recyclers in the U.S. cannot scale up a similar system due to high labor costs, but robotics can enable them to begin chip recovery in an economical way.

Once chips are harvested, they also need to be tested before being sold into resale channels. Again, in the U.S. the labor costs make this a difficult practice to pencil out, but robots can perform tasks like chip assessment, as well as testing and assessing the quality of other common devices like hard drives, laptops, servers and routers.

Another application comes in the data destruction field. AI and IT cloud services rely heavily on data centers, and most of the drives that are used in these facilities have large capacities of 4, 6 or 10 terabytes. Here, too, automation can help. Data-wiping a single 10-terabyte hard drive can take as long as 22 hours, and if a company needs to handle hundreds of thousands of these a month, the time and cost adds up. Robotics can be employed to destroy data efficiently at a relatively low cost.

Even in smaller hard drives, robotics-enabled data destruction can help: The resale value for 500-gigabyte and 1-terabyte drives is often too low to justify their recovery and data destruction, but automation can change that equation, enabling low-cost data wiping.

Robots can also improve general facility logistics. For large recyclers, maintaining storage space and efficient organization is key to keeping costs down, and robots can allow companies to condense storage space and speed up their pallet cargo flow inside their facilities. Ecommerce giant Amazon has set an example, utilizing in-facility robots that retrieve inventory, transport items across the warehouse floor, store items in hard-to-reach places, create precise packaging, and more.9

Our projections for the robotic opportunity in the US e-waste sector

Robotics can be a core tool to keep more e-waste domestic, rather than shipping it overseas for processing. Sourcing of critical metals, and particularly rare earth minerals, is a hot topic currently, with the U.S. seeking to reduce reliance on overseas resources. If e-waste continues to be sold to Malaysia and China, the resources inside those devices will belong to those countries. If we can bring more affordable e-waste disassembly options into the U.S., it will improve the domestic metals supply.

Robotic disassembly is particularly exciting for its potential to boost rare earth recovery from ewaste. Rare earth sourcing has become a high-profile issue recently as part of global trade tensions, leading U.S. companies and the federal government to look into ways of domestic sourcing.10

E-waste offers a prime source to recover these metals: Rare earths are found in electronics in components such as the vibrating motor in mobile phones, the magnets in hard drives, display screens, compact fluorescent lamps, medical imaging equipment, laser devices, power generators, and electric vehicle (EV) batteries. If these components are shredded or combusted, those rare earth metals are typically lost because they make up less than 1% of the resulting metal stream. The only way to harvest these metals is through disassembly and removing the components so they remain intact.

We estimate that wider adoption of robotics in the e-waste industry can generate 40,000 additional jobs in the U.S. As previously mentioned, there are an estimated 200,000 workers engaged in chip harvesting in Malaysia and China. If the U.S. were to scale up robotics-driven chip harvesting, it wouldn't create the same number of jobs, but it would generate many positions involved in maintaining those robots. We estimate every four robots involved in this type of e-waste processing needs a human employee to maintain it for proper operation.

And we have plenty of incentive to onshore chip supply. Recall the chip shortage during the COVID years, particularly 2020 through 2023, when sudden shifts in demand led to a supply and demand imbalance. The price of chips skyrocketed. In another such chip shortage, the ability to cost effectively harvest used chips domestically will be key to mitigating the damage.

Challenges in adopting robotic disassembly

Although robotics present a major opportunity for U.S. e-waste processing, there are some definite challenges that need to be addressed.

For one, the cost of the robots' operation can be funded by the value of recovering the tantalum capacitor on the printed circuit board and the chip. But it can be difficult to identify which chips are worth harvesting, because there can be so many on a single board and they vary in value.

Second, electronics recycling clients, the equipment suppliers such as major enterprises or data center operators, might believe their electronics are being recycled in the U.S., unaware that their equipment is being exported. We need greater awareness by the suppliers of the economics of e-waste processing. The suppliers need to understand that if the recycled material value is less than the cost to recover that material, processors are not willing to lose money on an ongoing basis, so the material may very well be exported. We need suppliers to be aware of this, because it will highlight the opportunity robotics present for greater domestic recovery.

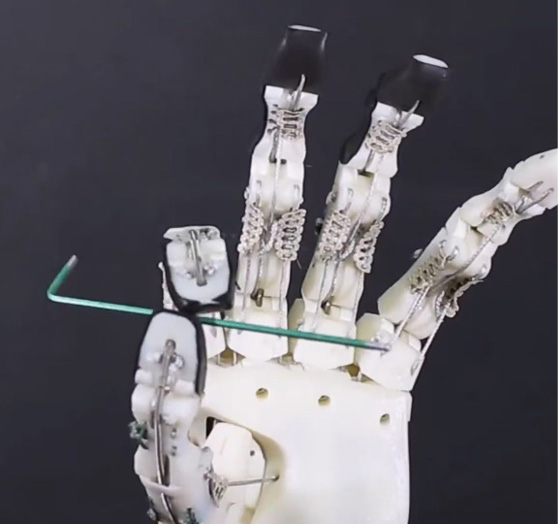

Device design is another challenge. The shape of devices is getting more and more sophisticated, and for robots, that means it's more difficult to disassemble. AI vision systems are helping with this problem, however, because they can learn and improve as they encounter more variances in device design. AI can also mitigate design differences by allowing use of a universal jig - the tool used in manufacturing and demanufacturing that holds the item being worked on and positions it for precision work.

For robots to have the greatest benefit, we also need to improve e-waste collection on a large scale in the U.S. Robotic processing will thrive when the robots can process large quantities of identical items. Scaling collection in this way will require government action, possibly through implementing mechanisms like point-of-sale deposits that are returned when a device is recycled. This would reduce the landfill rate dramatically and create a seismic change in the ewaste industry.

Dan Wang is a seasoned executive and innovative leader in the electronics and sustainability industries. With over 25 years of experience in manufacturing and operations, he has spearheaded advancements in capacitor technology and sustainable production practices. Currently, he serves as the CEO of Toyoshima Green Tech Inc., a company he founded in 2017, which develops green technology solutions, including chip refurbishment and robotic disassembly lines for routers and Chromebooks. Under his leadership, the company has achieved certifications from prominent organizations such as Wistron, Esco, and SMS Infocom. Mr. Wang has a degree in Business Administration and began his career at CAMEL Technology Inc., where he rose through the ranks to lead operations in Shanghai and Dongguan. He was instrumental in securing vendor certifications from global giants such as Schneider, Hitachi Media, and Foxconn. His visionary approach drove significant technological transformations, such as the shift from through-hole to surface-mount chip capacitors and the introduction of polymer-based dielectric capacitors. He has been recognized with awards, including Schneider's Best Supplier of Electronic Components.