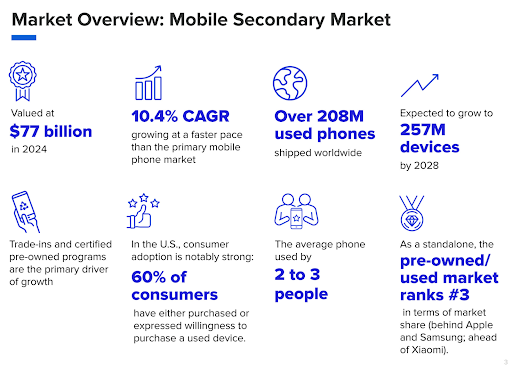

The used smartphone market is experiencing significant growth: valued at $77 billion in 2024, it continues to outpace the primary market and, as a standalone, ranks third in terms of market share (behind Apple and Samsung). This trend has prompted more carriers and OEMs to invest in trade-in, refurbishment, and certified pre-owned programs. Consider this: in a recent survey of OEMs and wireless carriers, conducted by B-Stock and CTIA’s Reverse Logistics and Service Quality Group, close to 70% plan to expand their trade-in programs while 80% plan to increase in-house repair capabilities in the next two years.

Driven by strong consumer trust and significant advancements in processing, grading, and repair, the pre-owned market will continue to grow, with the average phone being used by up to three people in its lifetime.

A Smarter Way Forward

For carriers and OEMs, the pre-owned mobile market has reached a new level of sophistication and scale, with advancements visible throughout the supply chain. Enhanced refurbishment standards, growing consumer trust in pre-owned devices, the rise of certified programs, and a greater focus on sustainability all reflect this maturation.

For example, GameStop recently introduced automated robotic grading and device cleaning for its trade-in devices slated for resale. During the receiving stage, the system reads and prints each device’s serial number on a sticker, which is then used for tracking throughout the process. The software also captures key details such as model, IMEI, memory size, FMIP status, carrier, and carrier blacklist status, all of which are stored and linked to the serial number. To ensure accuracy, GameStop references industry-standard grading criteria, including benchmarks from organizations like CTIA, to establish their grading standards.

At the final station, the system integrates the results of functional tests, device information, and robotic grading to determine the final grade for each device. The robotics system is dedicated to cosmetic grading—identifying scratches, chips, cracks, and chassis damage—while comprehensive functional testing is handled at the store level. This approach ensures grading consistency, which has been a top priority for customers and a key driver of improved satisfaction and retention.

According to Jon Haes, GameStop’s VP and Head of Pre-Owned Business, the continued development and expansion of automation and robotics will further enhance processing efficiency. Haes says, “For the mobile secondary market at large, the adoption of automation and robotics is likely to set new standards for efficiency and accuracy in device grading and processing. This trend may encourage other players in the market to invest in similar technologies, leading to widespread improvements in the overall industry.”

How Used Smartphones Support Sustainability and Growth

The smartphone lifecycle is a complex process involving multiple stages, with repair and refurbishment playing a pivotal role in sustainability and resource efficiency. Refurbished smartphones have an environmental footprint two to four times lower than new devices, mainly by avoiding the energy-intensive manufacturing process. But the benefits don’t stop there. Repairing and refurbishing used smartphones deliver significant environmental and economic benefits, including:

Reduction of Electronic Waste (E-Waste)

Smartphones play a significant role in global e-waste, as millions of devices are discarded each year. Unfortunately, much of this electronic waste contains harmful substances such as lead, mercury, and cadmium, which can leach into soil and waterways and pose risks to both ecosystems and human health. Currently, only a small fraction of e-waste is properly recycled, with global estimates suggesting this figure sits between 17% and 22%. Repairing or refurbishing smartphones can extend their lifespan, keep them out of landfills, and make a direct impact in reducing the amount of e-waste generated annually.

Conservation of Raw Materials and Resources

Manufacturing new smartphones demands the mining and processing of rare and precious metals like gold, silver, palladium, cobalt, and lithium—activities that are not only resource-intensive but also environmentally damaging. By choosing to repair or refurbish existing devices, the demand for these raw materials is reduced. For example, buying a refurbished smartphone instead of a new one can save approximately 575 pounds of raw materials over the course of two years (the average time a consumer owns a refurbished device). Water conservation is another important factor, as producing a single smartphone can require up to 3,200 gallons of water throughout its current manufacturing process.

Lowering the Carbon Footprint

Most of a smartphone’s carbon footprint actually results from its manufacturing phase, with each device generating between 66 and 187 pounds of CO₂ emissions over its life cycle. Refurbished smartphones, however, present a much more environmentally friendly alternative—their impact is typically two to four times lower than that of new devices. This is largely due to the fact that refurbishment avoids the energy-intensive processes involved in mining, manufacturing, and shipping new products across the globe.

Reduced Environmental Pollution

When discarded smartphones are incinerated or sent to landfills, they can release hazardous substances that contaminate the air, water, and soil, posing risks to both humans and the environment. By keeping devices in circulation through repair and refurbishment, these pollutants are prevented from entering the ecosystem.

Promotion of the Circular Economy

Repair and refurbishment are at the heart of the circular economy, a model designed to keep products in use for as long as possible while minimizing waste and reducing the need for new resource extraction. Initiatives such as trade-in programs, certified refurbishment, and responsible recycling not only support this sustainable model but also deliver both environmental and economic advantages. As these practices gain traction across the industry, device reuse is emerging as the dominant business model—aligning with environmental goals and growing consumer demand for value.

Cost-savings for Consumers

Buying a used or refurbished smartphone usually costs 30–50% less than purchasing a new one, making high-quality technology much more accessible and affordable. In addition to the initial savings, insurance premiums for refurbished phones tend to be lower as well, since their market value is reduced.

Market and Job Growth

The refurbishment and recycling industry is a driver of job creation, with employment opportunities in areas like collection, sorting, repair, testing, resale, and materials recovery. And as the secondary market continues to expand, it’s enabling the rise in refurbishers, resellers, and repair service providers, fostering small businesses and entrepreneurship.

Building a Better B2B Resale Strategy

Many industry leading carriers and OEMs leverage an online resale platform to achieve their B2B resale goals, support sustainability efforts, and promote the circular economy. Additionally, a strategic B2B resale program can integrate into your current systems and fit seamlessly into your broader operations with features such as integrated logistics, compliance, a single system of record, business intelligence, and payments. By leveraging a centralized B2B resale hub— that’s backed by technology and data and offers multiple channels to sell inventory— companies can quickly convert returned, trade-in, lease program, and overstock inventory into cash.

When choosing a B2B resale partner to build a better secondary market strategy, be sure to look for one that provides.

Global Demand

You’ll want access to a large and vetted group of global business buyers interested in merchandise across all brands, categories, conditions, and locations.

Suite of Resale Solutions

Whether your goal is to increase ASP, maintain high velocity, or ensure brand control, the best partners will help determine the best disposition strategy, including customized resale solutions that meet your needs.

System of Record

Find a single solution that can integrate with your current operations to store all of your resale inventory and track all historical transaction data in one centralized location.

Streamlined Operations for Accelerated Cycle Times

By using a technology-backed B2B resale solution, you can replace slow, manual reselling processes and automate invoicing and payment without having to worry about communications, dispute mediation, or shipment tracking.

Pricing and Performance Analytics

Quality data should be leveraged to understand seasonal demand, predict buyer behavior, and resale pricing. Find a partner that can offer vast, historical transaction data and advanced analytics to enable listing optimization, real-time insights on depreciation, and reliable price forecasting by model, storage, carrier, color, SKU, and more.

Compliant with Industry Standards

Find a B2B resale platform designed with compliance in mind, offering features such as data-wiping, R2 tracking, IP monitoring, OFAC checking, and certification standards to ensure all transactions meet rigorous industry requirements.

Payments & Risk

Find a reliable and trustworthy partner to handle all collections and credit programs on your behalf to ensure you maintain a steady cash flow.

Recommerce Program Management & Support

Look for an experienced account management team that offers a data-driven resale strategy, expert guidance on merchandise listings, and responsive customer support. Seek expertise and support to keep you informed of key industry developments and pricing trends in real time, and will help you to identify the best solutions for maximizing both sales velocity and average selling price (ASP).

Customer Service

Select a partner with 24/7 customer support who handles all disputes, inquiries, and communications, allowing you to focus on your primary business operations.

The Complete Lifecycle of a Smartphone

Smartphones are both essential and expensive; nearly everyone owns one and depends on it every day. This is why there is significant incentive to optimize the supply chain– encouraging the return of used smartphones for refurbishment and resale- to ensure that these devices remain in circulation and available to new consumers. To better understand this journey, check out B-Stock’s infographic to follow the path of a smartphone’s complete lifecycle from production through repair, multiple owners, and various resale channels to when it’s finally recycled years later.

The Future of the Mobile Secondary Market

Repair and refurbishment are critical for extending the functional life of smartphones, reducing the frequency of replacements, and minimizing environmental impact. Retailers and OEMs can no longer simply dispose of or destroy old phones. B-Stock partners with leading retailers, OEMs, and brands to provide sustainable B2B recommerce solutions. Backed by over a decade of mobile B2B resale data, B-Stock has sold over 34 million mobile devices to over 35,000 global business buyers, reducing waste and promoting environmentally responsible resale practices.

Stakeholders now recognize the immense opportunity in the pre-owned smartphone market, and it’s seeing rapid advancements in how devices are sourced, assessed, and sold. Trade-in programs are more robust than ever, grading and triage processes have become increasingly precise and efficient, thanks to innovations like AI-powered diagnostics and automated inspection systems. The mobile secondary market is not just growing– it’s evolving, with every link in the supply chain becoming more analytical, technology-driven, and focused on extracting the highest possible value.

B-Stock is the world's largest B2B recommerce platform and system of record for all resale. We connect sellers and buyers of returned, trade-in, and excess inventory through a suite of online resale channels. Our customers range from the world’s largest brands and retailers that want best-in-class inventory resale management to buyers of all sizes looking to source valuable merchandise for their resale businesses.