Strategies for Protecting your Data, Reputation and Sales Channels

By Dan Main, Bidpath Inc

Picture the scene. You're an electronics manufacturer with a reputation for high quality products. You receive a moderate volume of returns, but you resell any returned products you can’t restock via a liquidation marketplace to ensure a quick and easy sale process and maximum recovery.

Imagine your horror then, when you see over one quarter - not only have new sales reduced, but negative product reviews are appearing in key online sales channels. You dig into the numbers and realise that you're competing with your own products which you sold to liquidators! Not only that, but because many of these items are listed as new (when they are faulty or open box returns), your customers are having a negative experience with your products, and they're talking about it too!

Or maybe you're a retailer seeing a high return rate on own brand items, especially during seasonal peaks. You have a standard process where you email a list of buyers and sell the package to the one that offers the most. Fast forward to a news story where your brand label is clearly visible in a huge collection of returns dumped in Ghana. While you're not the only brand, your business becomes the poster child for the throw-away society.

This article looks at some of the risks that need to be managed when selling retail returns and how best to approach this.

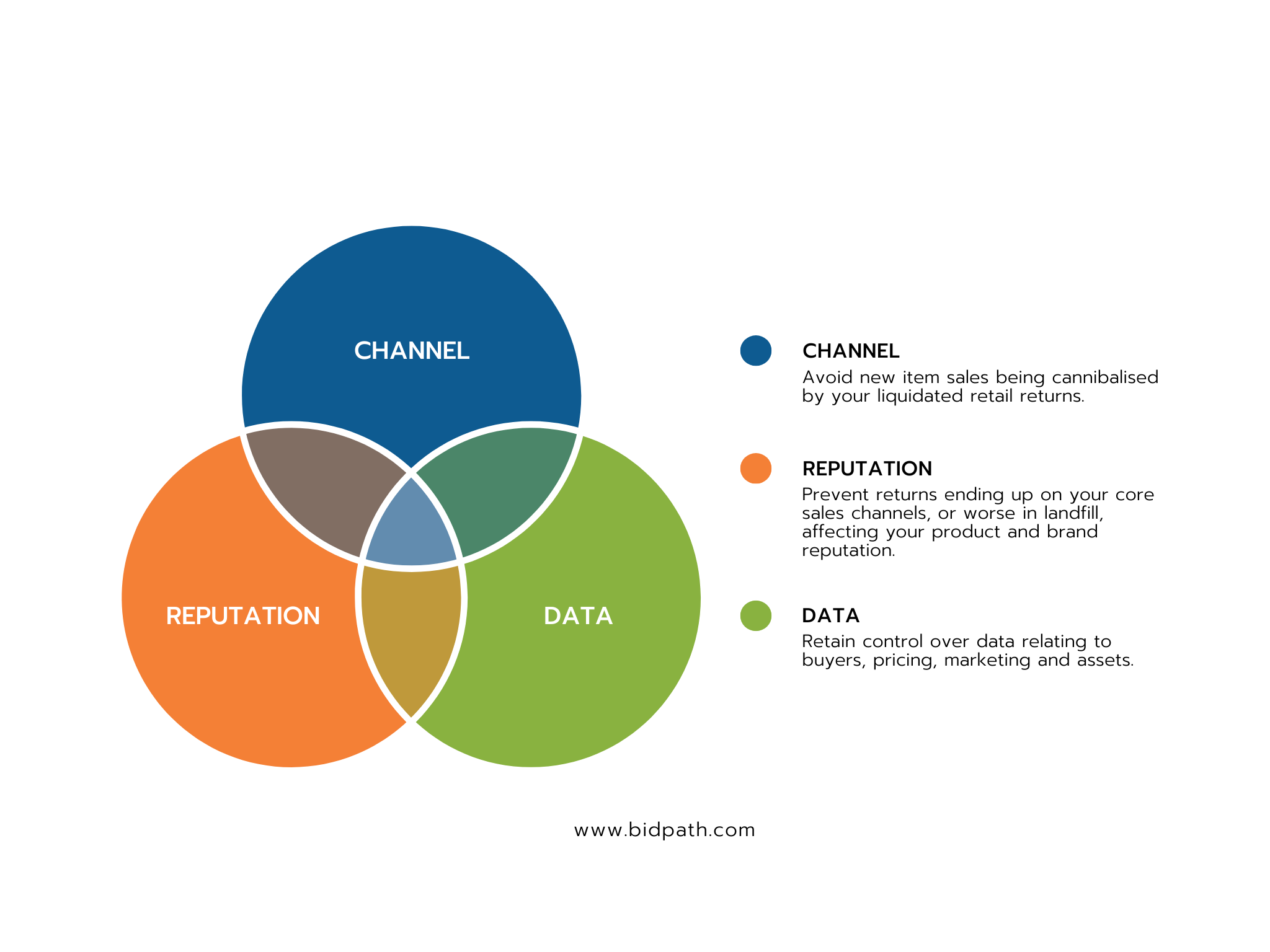

We'll cover three key areas of protection:

- Channel Protection

- Reputation Protection

- Data Protection

- Channel Protection

Put simply - you don't want sales of new items to be cannibalised by retail returns that you have liquidated.

Selling returns without any restriction can result in your new stock competing with liquidated returns on online marketplaces.

Many marketplaces allow for 3rd party sellers to sell branded items on their platform, and although there may be reputation scoring of the specific vendor on the channel, negative feedback on a product will impact anyone selling through that channel (including your own sales).

While this a key issue for manufacturers, if you’re a retailer you may also have restrictions on where and how you can resell returns (stipulated by the manufacturer).

So it stands to reason you would want to limit the channels and regions an item can be resold in. BUT - you need to make sure the route you use to sell returns can accommodate this. Whether it is through a liquidation marketplace, your own platform or a third party, you need to ensure controls are in place to limit the likelihood of items ending up in a channel that could impact you.

- Reputation Protection

Reputation falls into two categories in this context:

- Product Reputation - the perception of the quality of a product by consumers.

- Brand Reputation - the overall reputation of the company and their brand

Product Reputation

The Product Reputation relates to the perception of the quality of a product. In the case above, we looked at items being bought from liquidation, then resold on a channel as new - impacting both the sales of new items and the reputation of the product.

Uncontrolled resale of items by third party sellers can result in a manufacturers product reputation being negatively affected.

One example of a company trying to limit this is by Apple. Amazon agreed that if they could list new Apple items on the site directly from Apple, then they'd remove all unauthorised third-party sellers from the platform. Other examples include Hasbro, who Amazon required proof of permission from for third party sellers listing their products.

While you may not be able to stipulate these conditions with your selling marketplace, you can try to restrict items getting to the resellers in the first place.

Brand Reputation

Brand Reputation relates to the perception of the brand and the company, it's a wide ranging topic but in the case of retail returns it is closely tied to Environmental, Social and Governance (ESG) factors:

Environmental

Estimates vary, but around 25% of retail returns are still believed to go to landfill or Energy from Waste. Considering some companies report as much as 50% return rates, this remains a significant issue. Consumers are becoming more aware of this, and stories of branded products being found in landfill sites in Africa and South America can present considerable harm to a brands reputation.

Any measures to increase the amount of returns that you are selling should be embraced, especially if they represent an alternative to sending them to landfill. A variety of sales channels including auctions, liquidation marketplaces and direct sales can all be an effective way of increasing the volume traded. And as we showed in our previous RLA blog article and webinar, if you are avoiding sending to landfill, you can measure this success in terms of carbon avoided and report it (see ‘sources and further reading’).

Social

At the time of writing in 2023, we are living in a global cost of living crisis, compounded by inflation, rising interest rates and supply chain disruption. The idea that usable items are being thrown away in such circumstances attracts negative attention, even when the items may not be directly linked with the original brand (in the case of charity donations being dumped in Chile and Ghana).

At the RLA 2023 EMEA Summit, we were delighted to see members and attendees from Africa and the Middle East - but this region is still under-represented. Speaking to Anthony Goldberg from Antel in South Africa - Africa as a whole is a key region that can benefit from discounted returned goods being sold to the population there, and there is untapped demand in this market.

Requiring items are exported to other regions is a way of further reducing the chances of channel conflict in the original region. However - great care should still be taken that items do not then end up in landfill in that region if they're not resold through the intended routes.

Governance

Some retailers and manufacturers will try to control the problems above by restricting sales to a closed tender process between a small number of selected clients. As detailed above - it is a common approach to compile a spreadsheet of items, email it to a group of known buyers requesting offers, and the highest offer wins the package.

However - there are two risks to this route, transparency and value:

- Transparency: by not operating transparently, the resale process is open to criticism and is difficult to measure or audit (and therefore also hard to improve on).

- Value: If you are selling via a closed tender process to the same selection of buyers without competitive bidding, you are leaving money on the table.

Buyers get used to the pricing level required to win a package of assets, so there is no incentive to bid higher. One of our clients came to us with a system along these lines - spreadsheets emailed to a selection of buyers, accepting the maximum bid. We put in place a competitive bidding platform, linked by APIs to their existing systems, and within months they had expanded the process globally.

In addition to reputation, changes in legislation may force further ESG changes - indeed, France has implemented legislation to prevent brands from sending usable items to landfill, and 'Right to repair' legislation will impact returns in the EU and beyond.

Embracing strategies that tackle ESG concerns is about protecting the long term value of businesses - George Serafaim, writing in HBR stated "positive action and transparency on ESG matters can help companies protect their valuations as more global regulators and governments mandate ESG disclosures".

Furthermore - beyond the moral imperative, it just makes business sense. It costs money to send assets to landfill, it costs money not to have a competitive bidding process - both in actual terms of revenue lost. George Serafeim again: "Pursuing this work isn’t about ESG ratings per se—it’s about using ESG integration to create new forms of competitive advantage."

Data Protection

Selling on a liquidation marketplace may mean publicly sharing data that could be considered key business intelligence. It may also prevent you from accessing data that should inform your retail returns strategy, if this data remains the property of the marketplace.

For this article we've focused on data related to business intelligence from selling returns - data security areas such as data wiping are beyond the scope of the article and are well covered in other resources provided by the RLA.

Data can include:

Buyer Data

Any liquidation marketplace relies on the quality of the vendors and their assets to bring in buyers. You have to decide whether you want to share buyers via a marketplace, or manage your own platform where you control which buyers are able to purchase from you.

With your own platform – you are not competing to sell your returns with other sellers, you have a direct relationship with buyers and control over the buyer experience. This longer-term approach can lead to more transactions and higher returns. From a risk perspective, you can also be selective on who can buy your retail returns, and when banning non-compliant buyers.

Pricing Data

Most liquidation marketplaces publicly display the item sale price, even if only briefly once bidding has ended. This data could be valuable to competitors, but also could obstruct your sales of retail returns on other channels - if buyers through other channels can see that your items on liquidation marketplaces are cheaper than they pay you direct, they may be tempted to switch.

In addition, your pricing data should be used for your own analysis to guide selling decisions - including optimum lot sizes, seasonality and sale timing. This data can also be fed back to other parts of your business to influence decisions in manufacturing, purchasing and return policies. For example, PVH demonstrated at RLA 2023 that they have set dynamic return periods as a result of the demand for products over the season - if you buy a clothing item at the end of a season, you will have a shorter return period than if you bought at the start of the season.

Marketing Data

Marketing data includes views, traffic, time on site/engagement, in addition to the number and types of bidders registering for your sale. All this data is an indicator of demand and helps you to assess which assets best fit with the sales channel you are operating in - we regularly work with our clients to help them interpret marketing data.

In addition, with your own platform you can directly influence the SEO of the platform, through content marketing and targeted promotion.

Asset Data

By seeing the brand, categories and volume of returns being sold on your site, your competitors could use this information against you - if you're a retailer, through their own negotiations with the brand you're selling, or if you're a manufacturer, to identify weaknesses in your product portfolio.

It also means that your resales are competing for space with other retailers and manufactures - the higher a volume that is listed on the marketplace, the more saturated and the higher competition from other returns, accordingly the lower realisation you are likely to see.

Key Actions

To manage the risks from channels, reputation and data, here are some actions you can take:

- Channel

- Set the terms of resale (regional, channel, timing etc) up front and make them clear. Make them specific to each individual unit you are selling, if required.

- Require proof that your terms have been adhered to - if they need to leave the country, get proof of export.

- If items need to be de-branded, make unscheduled inspections of facilities to ensure this is happening.

- Monitor non-compliance out in the field, and where necessary in the event of non-compliance implement restrictions and/or removal of platform access, either on a temporary or permanent basis (depending on how damaging the non-compliance).

- Restrict further access - not only do you need to suspend or remove the original account, but also use IP address monitoring to limit the likelihood of that user re-registering.

- Be selective - decide which items can be sold openly, which need restricted visibility, and which require stringent resale terms.

- Consider holding private sales of sensitive items, with specifically invited bidders.

- Data

- Ensure that all data remains yours and you are given access to data that feeds your retail return decisions.

- As above, consider making sales private and closed - so there is limited chance of external parties viewing the pricing and asset data.

- If your current partner won't give you the data you need (after all, it's your data), push for it or find a new partner!

- Reputation

- If you aim to control sales channels and take control of your data, you're going to limit the negative impact on reputation.

- Anything that helps keep items out of landfill and make a transparent process will positively effect ESG and in turn your reputation.

- Selling at auction can be a more transparent process. Even if the sales are not public, as long as there are multiple buyers to ensure competitive bidding, the price still reflects a competitive process and the optimum price within the restrictions imposed. It is also easier to break down packages for an auction, resulting in a higher realisation overall.

Conclusion

In liquidating retail returns, there is a careful balance required to optimise realisation while effectively managing the risks. There are factors we can try to control, factors we can influence, and factors beyond our control - but with an awareness of all these areas you can minimise the risks posed to your business.

Owning and controlling your data, setting terms that limit the impact resold returns can make, embracing methods that allow more items to be sold and running a competitive process all help to protect your business from the risks we have identified above.

Sources and Further Reading:

Measuring Carbon from Auctions

https://rla.org/media/article/news-and-views/relationship-reverse-logistics-landfill

Returns to Landfill

Source: https://edition.cnn.com/2021/01/30/business/online-shopping-returns-liquidators/index.html

Apple and third party sellers

Source: https://edition.cnn.com/2018/11/10/tech/amazon-apple-deal-sellers/index.html

HBR and ESG

Source: https://hbr.org/2020/09/social-impact-efforts-that-create-real-value

Dan Main

Dan MainDan Main is a director at Bidpath, which provides white label auction platforms for retailers, manufacturers and auctioneers.

Dan has worked closely with retailers, manufacturers, government agencies and financial institutions over the last 18 years to help evaluate surplus assets and design and implement strategies to optimise their resale. He has helped find new homes for items as diverse as military Humvees, the microphone used to record The Queen’s Christmas Day message, and $10 million of audio-visual equipment over 3 days.

He lives in Cornwall, UK with his wife Salena and 1000 house plants.