Managing Outsourced Reverse Supply Chain

By Ivan Russo, Daniel Pellathy Ayman Omar, UNIV - Verona, Grand Valley State, American

Retail sales increased 3% over the 2020 holiday season, beating forecasts. But under that strong headline number is a corresponding increase in returns. According to the National Retail Federation, retailers expect over 13% of merchandise sold during the 2020 holidays will be returned. Ecommerce, meanwhile, averages 30% returns, with online returns more than doubling in 2020 and Processing online returns can cost retailers $10-$20 per item. Overall, returns represented over $400 billion for the year.

Managing reverse flows is a serious challenge for even the most seasoned supply chain. From specific tasks like collecting, inspecting, and disposing of inventories to broader issues of system design, companies can quickly become overwhelmed. Both Amazon and Walmart have found it cheaper in some cases to simply refund purchases and let customers keep products, rather than deal with the return. Most companies are not even at the point where they can accurately track the costs and so continue to service returns at a loss.

Partnering with 3PLs that have specific expertise in reverse flows can therefore be critical. Over the last decade, 3PLs have invested heavily in physical infrastructure and technical capabilities needed to manage reverse flows. Many 3PLs can now provide basic reverse services, while 3PL leaders are often able to develop solutions to enhance customer engagement and overall performance.

Unfortunately, the same lack of knowledge that keeps companies from successfully managing their own reverse operations also keeps them from engaging 3PLs in ways that maximize outcomes. Companies simply don’t have a clear sense of what can be achieved. As a result, their conversations with 3PLs tend to be limited in scope, focused primarily on cost reduction and process efficiency. Our research suggests several steps companies can take to ensure they are capturing the true value of reverse operations while at the same time driving innovation throughout their supply chain.

One of the most significant findings of our research is that manufacturers need to be willing to give control of their reverse operations to their 3PL. Reverse operations can be high stakes, with customers demanding hassle free returns as a baseline for doing business. Companies can be hesitant to hand over control of such an important segment of the supply chain to their 3PL. This is the wrong move. In other words, when manufacturers were willing to cede control of reverse operations to their 3PL, the outsourcing engagement tended to generate meaningful system innovations. In other words, 3PLs were able to create far more value for their clients when those clients were willing to relax control over their operations.

On the other hand, there are opportunities for those companies that wish to maintain control. The key in these situations is for companies to set the right level of expectations in terms of desired outcomes. Companies that want to retain control over their reverse operations should expect their 3PL to deliver mostly efficiency improvements to existing processes rather than new initiatives that can transform the overall system.

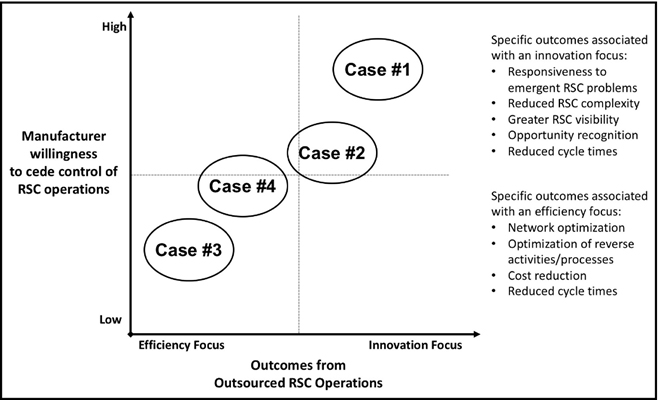

Fig 1. Russo, I., Pellathy, D., & Omar, A. (2021) Managing outsourced reverse supply chain operations: Middle‐range theory development. Journal of Supply Chain Management. https://onlinelibrary.wiley.com/doi/full/10.1111/jscm.12244

As illustrated in Figure 1, in Cases #3 and #4, the manufacturer’s tight control meant that innovation-related initiatives simply did not play a large part in shaping the overall outsourcing engagement. In contrast, in Cases #1 and #2, the manufacturer’s willingness to cede control provided room for the 3PL to develop and implement creative solutions that fit the manufacturer’s desire to move beyond operational efficiency. As Figure 1 suggests, then, there can be both “matches” and “mismatches” between the level of control and expectations. The lower left and upper right quadrants represent “matches,” insofar as the manufacturer cedes a level of control consistent with its expected outcomes. Whereas the upper left and lower right quadrants represent “mismatches,” where a manufacturer cedes control far beyond the efficiency outcomes it hopes to achieve, or, where a manufacturer expects innovation-related outcomes but fails to ceded sufficient control. Being aware of these potential “matches” and “mismatches” can help companies better communicate their expectations and engage appropriately with their 3PLs to achieve desired results.

It’s also important to note that relations with 3PLs can evolve over time. For most companies, a greater willingness to cede control to 3PLs, coupled with an emphasis on relational governance mechanisms, allows outsourcing engagements to evolve from a narrower focus on efficiency gains toward a broader focus on innovation. But managers must be intentional in their efforts to learn about reverse operations through ongoing interactions with their 3PLs. Indeed, our findings suggest a manufacturer’s interactions with its 3PL, and the evolution of the relationship over time, may influence outcomes more than the starting point of the outsourcing engagement. In other words, learning may influence outcomes more than the choice of any initial predetermined approach. Over time, companies may even find that expanding their understanding of the value that can be created from reverse operations can lead to improvements in their forward supply chains as well. With the help of their 3PL, companies are able to develop new approaches to managing forward and reverse flows as an integrated whole.

Current trends of retail shifting towards digital platforms suggest that there will be an additional emphasis to better manage the reverse channels. Whether it is the need to reduce operational costs or provide additional value-added services to the end consumers, finding profitable and innovative solutions to managing reverse operations is critical. Fortunately, companies don’t have to find these solutions on their own. Companies can leverage innovative approaches to reverse supply chain operations through an experienced 3PL by giving them the space to innovate.

Russo, I., Pellathy, D., & Omar, A. (2021) Managing outsourced reverse supply chain operations: Middle range theory development. Journal of Supply Chain Management.

https://onlinelibrary.wiley.com/doi/full/10.1111/jscm.12244

Ivan Russo, Daniel Pellathy Ayman Omar

Ivan Russo, Daniel Pellathy Ayman OmarAUTHOR

Ivan Russo (Ph.D.) is Professor at University of Verona (Italy). His research focuses on closed loop supply chain and circular economy, logistics service quality, the interplay between marketing & logistics, omnichannel strategy and customer loyalty. He is also specialized in Qualitative Comparative Analysis (QCA) as a complexity-informed method for evaluating supply chain complexity.

AUTHOR

Daniel Pellathy (Ph.D. in Supply Chain Management from the University of Tennessee‐Knoxville) is an assistant professor of Operations and Supply Chain Management at Grand Valley State University. His professional background includes enterprise risk management, and he continues to actively consult with companies across a broad range of issues related to strategic supply chain planning, organizational alignment, supply chain risk, and end-to- end operational excellence.

AUTHOR

Ayman Omar (PhD in Supply Chain Management, The University of Tennessee) is an associate professor in the Department of IT and Analytics and associate dean of Graduate Programs and Student Services at Kogod School of Business, American University. Professor Omar’s research interests target different aspects of global supply chain management. Primarily, his focus is on global supplier governance, cyber risks in global supply chains, and global supply chain sustainability.